to the Members of C&C Group Plc

Report on the audit of the financial statements

Opinion

We have audited the financial statements of C&C Group plc (‘the Company’) and its subsidiaries (‘the Group’) for the year ended 28 February 2021, which comprise;

- the Consolidated Income Statement and the Consolidated Statement of Comprehensive Income for the year then ended;

- the Consolidated Balance Sheet and the Company Balance Sheet as at 28 February 2021;

- the Consolidated Cash Flow Statement for the year then ended;

- the Consolidated Statement of Changes in Equity and the Company Statement of Changes in Equity for the year then ended; and

- the notes forming part of the financial statements, including the Statement of Accounting Policies set out on pages 151 to 166.

The financial reporting framework that has been applied in their preparation is Irish Law and International Financial Reporting Standards (IFRS) as adopted by the European Union and, as regards the Company financial statements as applied in accordance with the provisions of the Companies Act 2014 and Accounting Standards including FRS 101 Reduced Disclosure Framework.

In our opinion:

- the Group financial statements give a true and fair view of the assets, liabilities and financial position of the Group as at 28 February 2021 and of the Group’s loss for the year then ended;

- the Company financial statements gives a true and fair view of the assets, liabilities and financial position of the Company as at 28 February 2021;

- the Group financial statements have been properly prepared in accordance with International Financial Reporting Standards (IFRSs) as adopted by the European Union;

- the Company financial statements have been properly prepared in accordance with FRS 101 Reduced Disclosure Framework; and

- the Group financial statements and Company financial statements have been properly prepared in accordance with the requirements of the Companies Act 2014 and, as regards the Group financial statements, Article 4 of the IAS Regulation.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (Ireland) (ISAs (Ireland)) and applicable law. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Group and Company in accordance with ethical requirements that are relevant to our audit of financial statements in Ireland, including the Ethical Standard as applied to public interest entities issued by the Irish Auditing and Accounting Supervisory Authority (IAASA), and we have fulfilled our other ethical responsibilities in accordance with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the directors’ use of the going concern basis of accounting in the preparation of the financial statements is appropriate. Our evaluation of the directors’ assessment of the Group and Company’s ability to continue to adopt the going concern basis of accounting included:

Risk assessment procedures

- Obtained an understanding of management’s process for the use of the going concern basis of accounting. Events or conditions were identified, and audit procedures designed to evaluate the effect of these on the Group’s and the Company’s ability to continue as a going concern; and

- Involved members of our internal corporate finance and modelling specialists as part of the audit team to support procedures in respect of the model used and the scenarios considered.

Management’s process for assessing going concern

- In conjunction with our walkthrough of the Group’s financial statement close process, engaged with management early to ensure key factors were considered in their assessment including controls;

- Obtained management’s board-approved forecast cash flows and covenant calculations covering the period of assessment from the date of signing to 31 August 2022 (“going concern assessment period”), along with the Group’s assessment models for the going concern base case and reasonable worse case scenarios;

- Using our understanding of the business and through inspection and testing, evaluated and determined, whether the forecasting model and methods adopted by management in assessing going concern were appropriately sophisticated to be able to make an assessment for the entity; and

- Considered the consistency of information obtained from other areas of the audit such as the forecasts used for impairment assessments.

Assumptions

- Considered past historical accuracy of management’s forecasting (prior to COVID-19);

- Tested the assumptions included in each modelled scenario. Noting that the model was prepared on a top down basis, driven by volumes sold within each business unit and channel with different assumptions around the phased reopening of the on-trade channel for England, Scotland and Ireland, we reviewed and challenged the phasing assumptions. The assumptions were predicated on available Government guidance for each region;

- Tested the forecast models for each scenario to ensure that they were mathematically accurate;

- Evaluated the relevance and reliability of the underlying data used to make the assumptions included in the assessment by corroborating underlying data to available Government guidance, trading experienced throughout 2020 amid varying degrees of restrictions and social distancing guidance in each region; and

- Considered industry reports and market data for indicators of contradictory evidence, including a review of profit warnings within the sector.

Debt facilities / liquidity

- Performed a detailed review of all borrowing facilities to assess their continued availability to the Group through the going concern assessment period and to ensure completeness of covenants identified by management;

- Verified the covenant waivers in place covering the August 2021 and February 2022 measurement dates, which were replaced by a gross debt cap and the requirement to maintain a minimum level of available liquidity (the “Minimum Liquidity Requirements”) amounting to €150m with a reduction to €120m for the month ending 31 July 2021; reduction to €80m for the month ending 30 June 2022; and a reduction to €100m for the month ending 31 July 2022; and

- Considered the accuracy of management’s forecast model in complying with the Minimum Liquidity Requirements by reference to the above amounts.

Stress testing and Management’s plans for future actions

- Performed sensitivity analysis assuming a further lockdown and cessation of on trade business for the October to December 2021 period with a gradual re-opening in January and February 2022, which indicated that there was still liquidity headroom under this scenario;

- Assessed the plausibility of management’s reasonable worse case scenario by evaluating the actual COVID-19 impact on the Group subsequent to the year end and considering industry outlook analysis; and

- Evaluated management’s ability to undertake mitigating actions to reduce cash outflows during the going concern assessment period in order to determine whether such actions are feasible.

Disclosures

Reviewed the Group’s going concern disclosures in the financial statements to ensure they are in accordance with International Financial Reporting Standards.

Our key observations

The going concern assessment is most sensitive to the level of phased re-opening of the on-trade business during the assessment period. Under both the base case and reasonable worse case scenarios, the Group is not forecasted to breach the Minimum Liquidity Requirement during the going concern assessment period. Our sensitivity testing indicated that there was still liquidity headroom when the additional stress assumptions outlined above were applied, with periods of lower headroom caused by the timing of working capital flows and the timing of specifically identified outflows.

Conclusion

Based on the work we have performed, we have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the Group and Company’s ability to continue as a going concern for a period of at least twelve months from when the financial statements are authorised for issue.

In relation to the Group and Company’s reporting on how they have applied the UK Corporate Governance Code, we have nothing material to add or draw attention to in relation to the directors’ statement in the financial statements about whether the directors considered it appropriate to adopt the going concern basis of accounting.

Our responsibilities and the responsibilities of the directors with respect to going concern are described in the relevant sections of this report. However, because not all future events or conditions can be predicted, this statement is not a guarantee as to the Group’s or the Company’s ability to continue as a going concern.

Overview of our audit approach

Audit scope |

|

Key audit matters |

|

Materiality |

|

What has changed? |

|

Key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the financial statements of the current period and include the most significant assessed risks of material misstatement (whether or not due to fraud) that we identified, including those which had the greatest effect on: the overall audit strategy, the allocation of resources in the audit; and directing the efforts of the engagement team. These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

Risk | Our response to the risk | Key observations communicated to the Audit Committee |

Recoverability of on-trade receivable balances and advances to customers (Trade receivables 2021: €75.9m, 2020: €93.1m, advances to customers 2021: €42.1m, 2020: €44.7m) The Group has a risk through exposure to on-trade receivable balances and advances to customers who may experience financial difficulty given the ongoing national and international lockdowns and restrictions in Ireland, the UK and across the world following the outbreak of COVID-19 which has resulted in the closure of pubs, bars, clubs and restaurants. Refer to the Audit Committee Report (page 88); and Statement of Accounting Policies (pages 163 to 164); and Note 15 of the Consolidated Financial Statements (pages 199 to 200). | We have performed a thorough review of the Expected Credit Loss (ECL) model in relation to on-trade receivables and advances with customers considering C&C’s use of top-down ‘management overlays’ to account for current macro-economic scenarios. As part of this review we critically assessed management’s assumptions and estimates for accuracy and robustness. We have also benchmarked assumptions used within the model to third party data where possible. Given the level of uncertainty and the sensitivity of judgements and estimates used, we reviewed all key assumptions used and judgements made in estimating ECL. | We completed our planned audit procedures with no exceptions noted. Our observations included our assessment of management’s methodology for calculating expected credit losses in accordance with IFRS 9. We focused on the significant judgements made by management, benchmarked key assumptions and the appropriate disclosure of these in the financial statements. |

Impairment assessment of goodwill & intangible brand assets (2021: €646.0m, 2020: €652.9m) The Group holds significant amounts of goodwill & intangible brand assets on the balance sheet. In line with the requirements of IAS 36: ‘Impairment of Assets’ (‘IAS 36’), management tests goodwill balances annually for impairment, and also tests intangible assets where there are indicators of impairment. The annual impairment testing was significant to our audit because of the financial quantum of the assets it supports as well as the fact that the testing relies on a number of critical judgements, estimates and assumptions by management. Judgemental aspects include cash-generating unit (‘CGU’) determination for goodwill purposes, assumptions of future profitability, revenue growth, margins and forecast cash flows, and the selection of appropriate discount rates, all of which may be subject to management override. Refer to the Audit Committee Report (pages 88 to 89); Statement of Accounting Policies (pages 157 to 158); and Note 12 of the Consolidated Financial Statements (pages 190 to 195). | Valuations specialists within our team performed an independent assessment against external market data of key inputs used by management in calculating appropriate discount rates, principally risk-free rates, country risk premia and inflation rates. We carefully considered the determination of the Group’s 6 CGUs, and flexed our audit approach relative to our risk assessment and the level of excess of value-in-use over carrying amount in each CGU for goodwill purposes and in each model for the impairment assessment for intangible brand assets. For all models, we assessed the historical accuracy of management’s estimates, corroborated key assumptions and benchmarked growth assumptions to external economic forecasts. We evaluated management’s sensitivity analyses and performed our own sensitivity calculations to assess the level of excess of value-in-use over the goodwill and intangible brand carrying amount and whether a reasonably possible change in assumptions could cause the carrying amount to exceed its recoverable amount. We considered the adequacy of management’s disclosures in respect of impairment testing and whether the disclosures appropriately communicate the underlying sensitivities, in particular the requirement to disclose further sensitivities for CGUs and intangible brands where a reasonably possible change in a key assumption would cause an impairment. The above procedures were performed by the Group audit team. | We completed our planned audit procedures with no exceptions noted. Our observations included our assessment of management’s impairment model methodology and then for each CGU and intangible brand model:

|

Assessment of the valuation of property, plant and equipment (PP&E) (2021: €139.3m, 2020: €146.7m) and impairment assessment of equity accounted investments (2021: €63.1m, 2020: €83.9m) The Group carries its land and buildings at estimated fair value, its plant and machinery using a depreciated replacement cost approach and motor vehicles and other equipment at cost less accumulated depreciation and impairment losses. During the year, all land and buildings and plant and machinery were subject to independent expert valuations. We considered the valuation of these assets to be a risk area due to the size of the balances and the lack of comparable market data and observable inputs such as market based assumptions, plant replacement costs and plant utilisation levels due to the specialised nature of the Group’s assets. The valuation of PP&E involves significant judgement and therefore is susceptible to management override. The Group’s interest in equity accounted investments comprise interests in associates and joint ventures. In line with the requirements of IAS 36: ‘Impairment of Assets’ (‘IAS 36’), management tests equity accounted investments where there are indicators of impairment. The impairment testing was significant to our audit because of the financial quantum of the assets it supports as well as the fact that the testing relies on a number of critical judgements, estimates and assumptions by management. Judgemental aspects include assumptions of future profitability, revenue growth, margins and forecast cash flows, and the selection of appropriate P/E multiple, all of which may be subject to management override. Refer to the Audit Committee Report (page 89); Statement of Accounting Policies (pages 155 to 156 and 154 to 155); and note 11 and note 13 of the Consolidated Financial Statements (pages 185 to 189 and 195 to 198) for PP&E and Equity accounted investments respectively. | For PP&E, we inspected the independent expert valuation reports in order to assess the integrity of the data and key assumptions underpinning the valuations. Our specialist valuation team performed an independent assessment on the reasonableness of the key assumptions and judgements underlying the valuations. We corroborated the key assumptions and considered consistency to market data and observable inputs. We considered the adequacy of management’s disclosures in respect of the valuation and whether the disclosures appropriately communicate the underlying sensitivities. For equity accounted investments our focus was on Admiral Taverns which is the Group’s most significant joint venture. We considered all quantative and qualitative factors in assessing management’s market based valuation. We assessed the historical accuracy of management’s estimates, corroborated key assumptions which included the reopening of on trade in England, the location and composition of the portfolio of pubs, the real estate value and assessed the level of trade since the pubs reopened for external trading in England. We have reviewed the adequacy of management’s disclosures in respect of the market valuation and whether the disclosures appropriately communicate the underlying sensitivities. All of the above procedures were performed predominantly by the Group audit team. | We completed our planned audit procedures with no exceptions noted. Our observations included:

|

Revenue recognition (2021: €736.9m, 2020: €1,719.3m) The Group generates revenue from a variety of geographies and across a large number of separate legal entities spread across the Group’s four business segments. The Group’s revenue particularly on supply, complex and non-standard customer contracts agreements may not have been accounted for correctly. In this regard we focused our risk on revenue generated in connection with certain of the Group’s arrangements with third parties entered into in order to utilise excess capacity and other material complex arrangements with customers. Revenue is an important element of how the Group measures its performance, and revenue recognition is therefore inherently susceptible to the risk of management override. Refer to the Audit Committee Report (page 89); Statement of Accounting Policies (pages 160 to 161); and note 1 of the Consolidated Financial Statements (pages 167 to 170). | We considered the appropriateness of the Group’s revenue recognition accounting policies; in particular, those related to supply, complex and non-standard customer contracts. For the purpose of our audit, the procedures we carried out included the following:

| We completed our planned audit procedures with no exceptions noted. Our observations included:

|

Our application of materiality

We apply the concept of materiality in planning and performing the audit, in evaluating the effect of identified misstatements on the audit and in forming our audit opinion.

Materiality

The magnitude of an omission or misstatement that, individually or in the aggregate, could reasonably be expected to influence the economic decisions of the users of the financial statements. Materiality provides a basis for determining the nature and extent of our audit procedures.

We determined materiality for the Group and Company to be €3.7 million, which is approximately 0.5% of the Group’s Net Revenue, (2020: €4.8 million based on 5% of the Group’s profit before tax before non-recurring exceptional items). We believe that Net Revenue provides us with the most appropriate performance metric on which to base our materiality calculation as we consider it to be the most relevant performance measure to the stakeholders of the Group.

During the course of our audit, we reassessed initial materiality and considered that no further changes to materiality were necessary.

Performance materiality

Performance materiality is the application of materiality at the individual account or balance level. It is set at an amount to reduce to an appropriately low level the probability that the aggregate of uncorrected and undetected misstatements exceeds materiality.

On the basis of our risk assessments, together with our assessment of the Group’s overall control environment, our judgement was that performance materiality was 50% of our planning materiality, namely €1.85 million (2020: €2.38 million). We have set performance materiality at this percentage based on our assessment of the risk of misstatements, both corrected and uncorrected, consistent with the prior year.

Reporting threshold

An amount below which identified misstatements are considered as being clearly trivial.

We agreed with the Audit Committee that we would report to them all uncorrected audit differences in excess of €0.18 million (2020: €0.24 million), which is set at 5% of planning materiality, as well as differences below that threshold that, in our view, warranted reporting on qualitative grounds.

We evaluate any uncorrected misstatements against both the quantitative measures of materiality discussed above and in light of other relevant qualitative considerations in forming our opinion.

An overview of the scope of our audit report

Tailoring the scope

Our assessment of audit risk, our evaluation of materiality and our allocation of performance materiality determine our audit scope for each entity within the Group. Taken together, this enables us to form an opinion on the Consolidated Financial Statements.

In determining those components in the Group to which we perform audit procedures, we utilised size and risk criteria when assessing the level of work to be performed at each entity.

In assessing the risk of material misstatement to the Group financial statements, and to ensure we had adequate quantitative coverage of significant accounts in the financial statements, we selected 18 (2020: 20) components covering entities across Ireland, UK, Luxembourg and the US, which represent the principal business units within the Group.

Of the 18 (2020: 20) components selected, we performed an audit of the complete financial information of 10 (2020: 10) components (“full scope components”) which were selected based on their size or risk characteristics. For the remaining 8 (2020: 10) components (“specific scope components”), we performed audit procedures on specific accounts within that component that we considered had the potential for the greatest impact on the significant accounts in the financial statements either because of the size of these accounts or their risk profile.

In addition to the 18 components discussed above, we selected a further 6 (2020: 6) components where we performed procedures at the component level that were specified by the Group audit team in response to specific risk factors.

The reporting components where we performed audit procedures accounted for 98.9% (2020: 99.6%) of the Group’s loss before tax, 99.6% (2020: 98.6%) of the Group’s net revenue and 99.5% (2020: 99.4%) of the Group’s total assets.

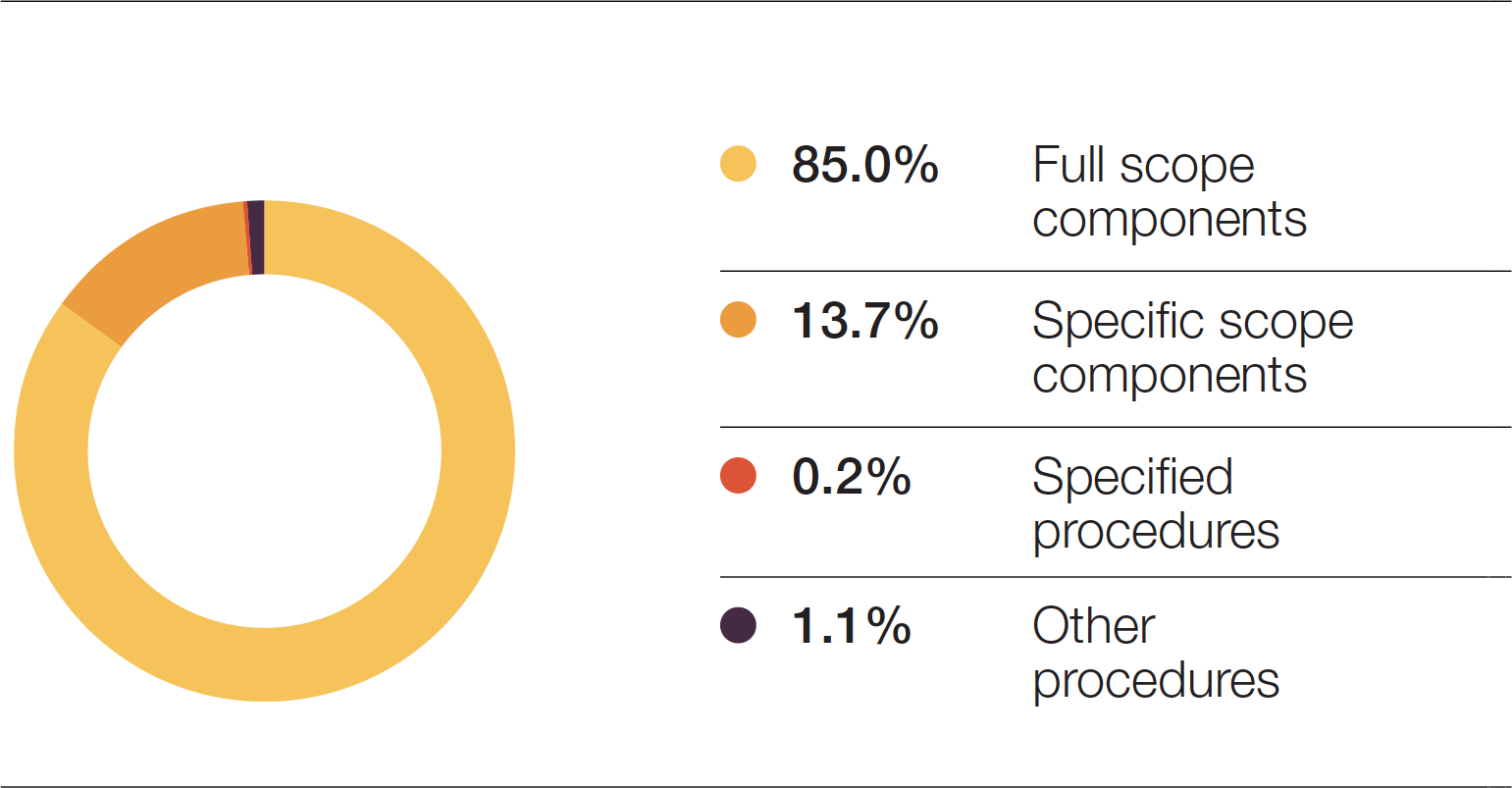

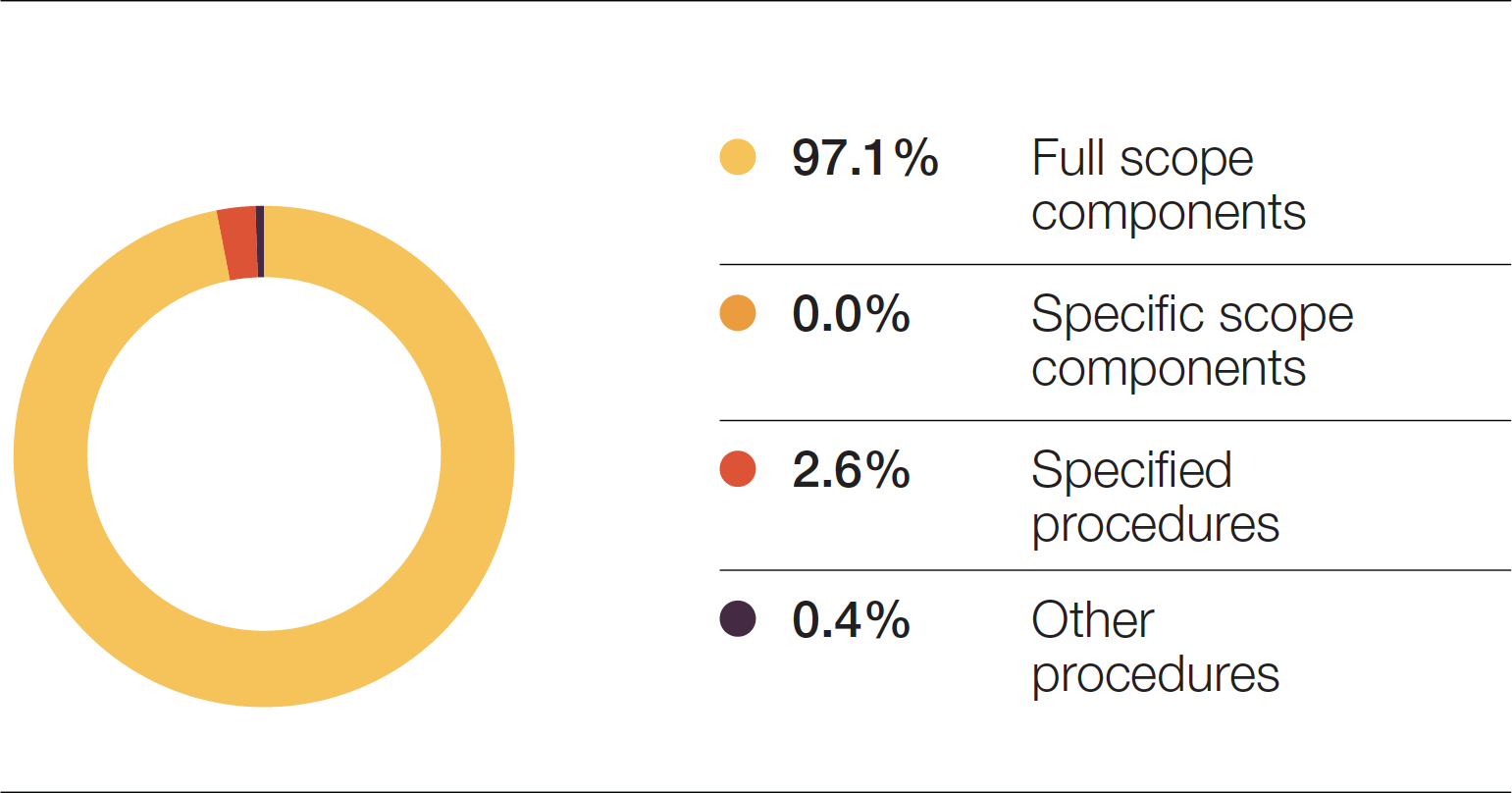

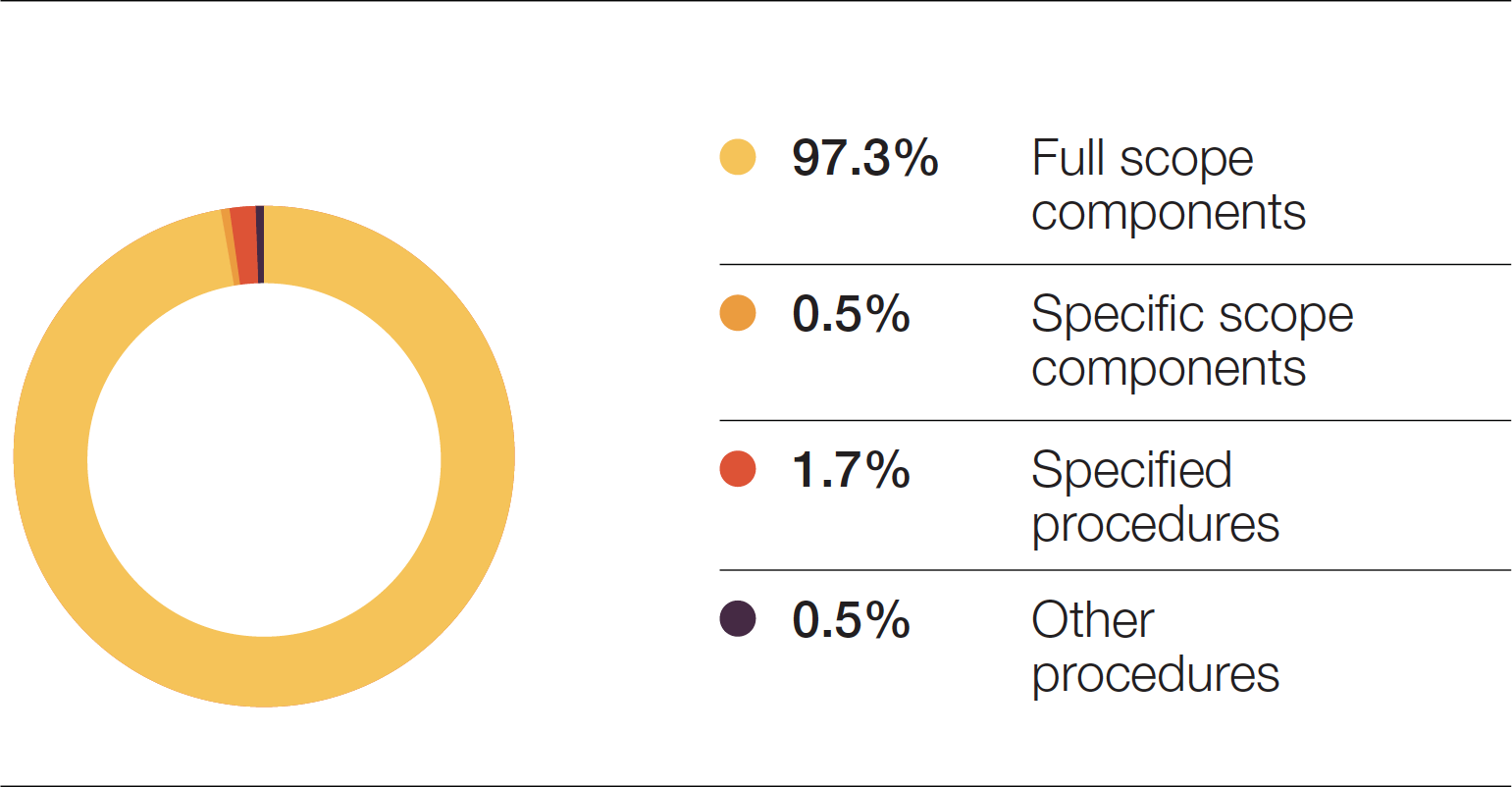

For the current year, the full scope components contributed 85.0% (2020: 85.0%) of the Group’s loss before tax, 97.0% (2020: 97.1%) of the Group’s net revenue and 97.3% (2020: 93.3%) of the Group’s total assets. The specific scope component contributed 13.7% (2020: 12.6%) of the Group’s loss before tax, 0.0% (2020: 0.0%) of the Group’s net revenue and 0.5% (2020: 0.4%) of the Group’s total assets. The components where we performed specified procedures that were determined by the Group audit team in response to specific risk factors contributed 0.2% (2020: 1.9%) of the Group’s loss before tax, 2.6% (2020: 1.5%) of the Group’s net revenue and 1.7% (2020: 5.7%) of the Group’s total assets. The audit scope of these components may not have included testing of all significant accounts of the component but will have contributed to the coverage of significant tested for the Group.

Of the remaining components that together represent 1.1% (2020: 0.4%) of the Group’s loss before tax, none are individually greater than 5% (2020: 5%) of the Group’s loss before tax before non-recurring exceptional items. For these components, we performed other procedures, including analytical review, testing of consolidation journals and intercompany eliminations and foreign currency translation recalculations to respond to any potential risks of material misstatement to the Group financial statements.

The charts below illustrate the coverage obtained from the work performed by our audit teams.

Loss before tax

Revenue

Total Assets

Involvement with component teams

In establishing our overall approach to the Group audit, we determined the type of work that needed to be undertaken at each of the components by us, as the primary audit engagement team, or by component auditors from other EY global network firms operating under our instruction. Where the work was performed by component auditors, we determined the appropriate level of involvement to enable us to determine that sufficient audit evidence had been obtained as a basis for our opinion on the Group as a whole.

We issued detailed instructions to each component auditor in scope for the Group audit, with specific audit requirements and requests across key areas. The Group audit team would normally have completed a programme of planned visits designed to ensure that senior members of the Group audit team, including the Audit Engagement Partner, visit a number of overseas locations each year. During the current year’s audit cycle, due to travel restrictions as a result of the Covid-19 pandemic, no physical visits were possible by the Group audit team. Instead, the Group audit team performed virtual visits in respect of our key component teams in the U.K., and Ireland. These visits involved discussing the audit approach and any issues arising with the component team and holding discussions with local management and attending closing meetings.

The Group audit team interacted regularly with the component teams where appropriate during various stages of the audit, reviewed and evaluated the work performed by these teams, including review of key reporting documents, in accordance with the ISAs (Ireland) and were responsible for the overall planning, scoping and direction of the Group audit process. Senior members of the Group audit team also participated in component and divisional planning, interim and closing meeting calls during which the planning and results of the audits were discussed with the component auditors, local management and Group management. This, together with the additional procedures performed at Group level, gave us appropriate evidence for our opinion on the Group financial statements.

Other conclusions relating to principal risks, going concern and viability statement

We have nothing to report in respect of the following information in the annual report, in relation to which the ISAs (Ireland) require us to report to you whether we have anything material to add or draw attention to:

- the disclosures in the annual report (set out on pages 32 to 42) that describe the principal risks and explain how they are being managed or mitigated;

- the directors’ confirmation (set out on page 32) in the annual report that they have carried out a robust assessment of the principal risks facing the Group and the Company, including those that would threaten its business model, future performance, solvency or liquidity;

- the directors’ statement (set out on page 41) in the financial statements about whether the directors considered it appropriate to adopt the going concern basis of accounting in preparing the financial statements and the directors’ identification of any material uncertainties to the Group’s and the Company’s ability to continue to do so over a period of at least twelve months from the date of approval of the financial statements;

- whether the directors’ statement relating to going concern required under the Listing Rules in accordance with Listing Rule 6.8.3(3) is materially inconsistent with our knowledge obtained in the audit; or

- the directors’ explanation (set out on page 41) in the annual report as to how they have assessed the prospects of the Group and the parent company, over what period they have done so and why they consider that period to be appropriate, and their statement as to whether they have a reasonable expectation that the Group and the parent company will be able to continue in operation and meet its liabilities as they fall due over the period of their assessment, including any related disclosures drawing attention to any necessary qualifications or assumptions.

Other information

The Directors are responsible for the other information. The other information comprises the information included in the Annual Report other than the financial statements and our auditor’s report thereon. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

In this context, we also have nothing to report in regard to our responsibility to specifically address the following items in the other information and to report as uncorrected material misstatements of the other information where we conclude that those items meet the following conditions:

- Fair, balanced and understandable (set out on page 89) – the statement given by the Directors that they consider the Annual Report and financial statements taken as a whole is fair, balanced and understandable and provides the information necessary for shareholders to assess the Group’s and the Company’s performance, business model and strategy, is materially inconsistent with our knowledge obtained in the audit; or

- Audit Committee reporting (set out on pages 86 to 91) – the section describing the work of the Audit Committee does not appropriately address matters communicated by us to the Audit Committee or is materially inconsistent with our knowledge obtained in the audit; or

- Directors’ statement of compliance with the UK Corporate Governance Code (set out on page 78) – the parts of the Directors’ statement required under the Listing Rules relating to the Company’s compliance with the UK Corporate Governance Code containing provisions specified for review by the auditor in accordance with Listing Rule 6.8.6 do not properly disclose a departure from a relevant provision of the UK Corporate Governance Code.

Opinions on other matters prescribed by the Companies Act 2014

Based solely on the work undertaken in the course of the audit, we report that:

- in our opinion, the information given in the Directors’ Report, other than those parts dealing with the non-financial statement pursuant to the requirements of S.I. No. 360/2017 on which we are not required to report in the current year, is consistent with the financial statements; and

- in our opinion, the Directors’ Report, other than those parts dealing with the non-financial statement pursuant to the requirements of S.I. No. 360/2017 on which we are not required to report in the current year, has been prepared in accordance with the Companies Act 2014.

We have obtained all the information and explanations which we consider necessary for the purposes of our audit.

In our opinion the accounting records of the Company were sufficient to permit the financial statements to be readily and properly audited and the Company statement of financial position is in agreement with the accounting records.

Matters on which we are required to report by exception

Based on the knowledge and understanding of the Group and parent company and its environment obtained in the course of the audit, we have not identified material misstatements in the directors’ report.

The Companies Act 2014 requires us to report to you if, in our opinion, the disclosures of directors’ remuneration and transactions required by sections 305 to 312 of the Act, which relate to disclosures of directors’ remuneration and transactions, are not complied with by the Company. We have nothing to report in this regard.

We have nothing to report in respect of section 13 of the European Union (Disclosure of Non-Financial and Diversity Information by certain large undertakings and groups) Regulations 2017 (as amended), which require us to report to you if, in our opinion, the Company has not provided in the non-financial statement the information required by Section 5(2) to (7) of those Regulations, in respect of year ended 29 February 2020.

Respective responsibilities

Responsibilities of directors for the financial statements

As explained more fully in the Directors’ Responsibility Statement set out on page 133, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as they determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the Group and the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Group or the Company or to cease operations, or has no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (Ireland) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

The objectives of our audit, in respect to fraud, are; to identify and assess the risks of material misstatement of the financial statements due to fraud; to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses; and to respond appropriately to fraud or suspected fraud identified during the audit. However, the primary responsibility for the prevention and detection of fraud rests with both those charged with governance of the entity and management.

Our approach was as follows:

- We obtained an understanding of the legal and regulatory frameworks that are applicable to the Group across the various jurisdictions globally in which the Group operates. We determined that the most significant are those that relate to the form and content of external financial and corporate governance reporting including company law, tax legislation, employment law and regulatory compliance

- We understood how C&C Group plc is complying with those frameworks by making enquiries of management, internal audit, those responsible for legal and compliance procedures and the Company Secretary. We corroborated our enquiries through our review of the Group’s Compliance Policies, board minutes, papers provided to the Audit Committee and correspondence received from regulatory bodies

- We assessed the susceptibility of the Group’s financial statements to material misstatement, including how fraud might occur, by meeting with management, including within various parts of the business, to understand where they considered there was susceptibility to fraud. We also considered performance targets and the potential for management to influence earnings or the perceptions of analysts. Where this risk was considered to be higher, we performed audit procedures to address each identified fraud risk. These procedures included testing manual journals and were designed to provide reasonable assurance that the financial statements were free from fraud or error

- Based on this understanding we designed our audit procedures to identify non-compliance with such laws and regulations. Our procedures included a review of board minutes to identify any non-compliance with laws and regulations, a review of the reporting to the Audit Committee on compliance with regulations, enquiries of internal and external legal counsel and management

A further description of our responsibilities for the audit of the financial statements is located on the IAASA’s website at: http://www.iaasa.ie/getmedia/b2389013-1cf6-458b-9b8f-a98202dc9c3a/Description_of_auditors_responsibilities_for_audit.pdf. This description forms part of our auditor’s report.

Other matters which we are required to address

We were appointed by the Audit Committee following an AGM held on 6 July 2017 to audit the financial statements for the year ending 28 February 2018 and subsequent financial periods. The period of total uninterrupted engagement including previous renewals and reappointments of the firm is 4 years.

The non-audit services prohibited by IAASA’s Ethical Standard were not provided to the Group and we remain independent of the Group in conducting our audit.

Our audit opinion is consistent with the additional report to the audit committee.

The purpose of our audit work and to whom we owe our responsibilities

Our report is made solely to the Company’s members, as a body, in accordance with section 391 of the Companies Act 2014. Our audit work has been undertaken so that we might state to the Company’s members those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company’s members, as a body, for our audit work, for this report, or for the opinions we have formed.

Pat O’Neill

for and on behalf of

Ernst & Young

Chartered Accountants and Statutory Audit Firm

Dublin

26 May 2021