Dear Shareholder

On behalf of the Board, I am pleased to present the Directors’ Remuneration Report (‘Report’) for the year ended 28 February 2021.

The Company is incorporated in Ireland and is therefore not subject to the UK company law requirement to submit its Directors’ Remuneration Policy (‘Policy’) to a binding vote. Nonetheless, in line with our commitment to best practice, the 2021 Policy will be put to our shareholders on an advisory basis. The Company’s existing Policy was approved at our 2018 AGM following a vote in favour of over 99%. Shareholders showed a similarly high level of support for our Directors’ Remuneration Report in 2020, with over 99% of votes in favour of it. These high levels of support reflect shareholders’ views of our responsible approach to executive remuneration, an approach that will continue under the new Policy. We hope that shareholders will demonstrate their support again this year.

Governance

The Committee has defined Terms of Reference which can be found in the Investor Centre section of the Group’s website. A copy may be obtained from the Company Secretary.

Remuneration Committee Membership and Meeting Attendance

The following Non-Executive Directors served on the Committee during the year:

Member | Member since | Number of Meetings Attended | Maximum Possible Meetings |

Helen Pitcher (Chair) | 1 March 2019 | 10 | 10 |

Jill Caseberry | 1 March 2019 | 10 | 10 |

Jim Clerkin* | 24 October 2019 | 8 | 10 |

* Jim Clerkin was unable to attend the meetings on 20 October 2020 and 10 February 2021 due to prior engagements.

All members of the Committee are and were considered by the Board to be independent.

The quorum necessary for the transaction of business is two, each of whom must be a Non-Executive Director. Only members of the Committee have the right to attend committee meetings, however, during the year, Stewart Gilliland (Chair), David Forde (CEO), Patrick McMahon (CFO) and the Group Director of Human Resources along with Independent Audit, a Board effectiveness firm, as explained on page 84, were invited to attend meetings (although never during the discussion of any item affecting their own remuneration or employment).

The Company Secretary is Secretary to the Committee.

Main Activities in FY2021

- Approval of the FY2020 bonus and LTIP measures;

- Approval of the Directors’ Remuneration Report for the financial year ended 29 February 2020;

- Reviewing and consulting with shareholders on the revised Directors’ Remuneration Policy and consideration of their feedback;

- Considering the FY2022 remuneration packages;

- Considering the impact of COVID-19 on the Executive and all employee remuneration arrangements;

- Approving the terms of the CFO, Jonathan Solesbury’s departure;

- Approving the terms of Patrick McMahon’s appointment as CFO;

- Approving the terms of David Forde’s appointment as CEO.

External Advisers

The Committee seeks and considers advice from independent remuneration advisers where appropriate. During the year ended 28 February 2021, the Committee obtained advice from Deloitte LLP. Deloitte’s fees for this advice amounted to £27,575 charged on a time or fixed fee basis. Deloitte is one of the founding members of the Remuneration Consultants’ Code of Conduct and adheres to this Code in its dealings. The Committee is satisfied that the advice provided by Deloitte is objective and independent. The Committee is comfortable that the Deloitte engagement team that provide remuneration advice to the Committee do not have connections with the Company that may impair their independence.

Business context (including new Chief Executive Officer and Group Chief Financial Officer)

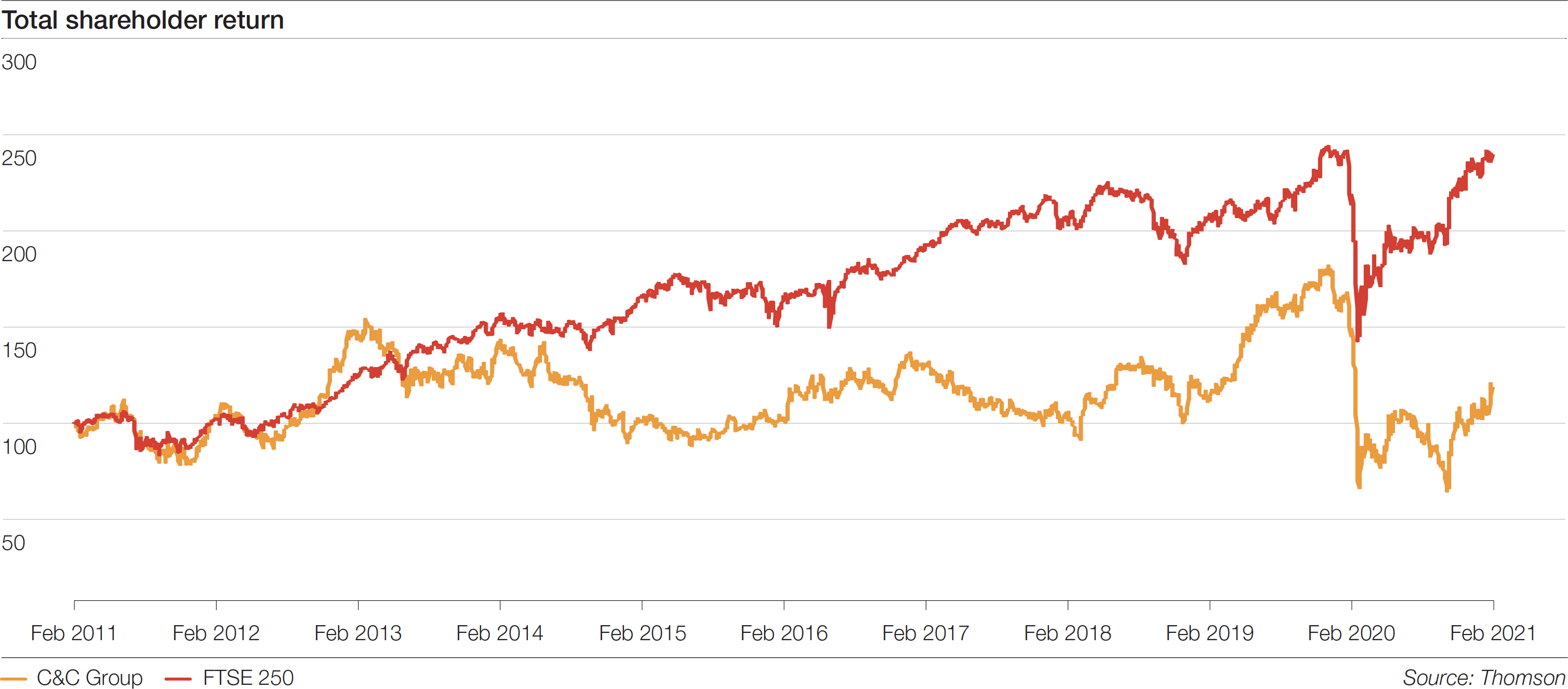

Since the last Policy review, the business has evolved significantly in scale, scope and complexity. We completed the acquisition of Matthew Clark and Bibendum in April 2018, a move which has significantly strengthened our brand led distribution model, broadened our operations and footprint and added circa 1,600 people to C&C. As the largest independent alcohol distributor across the UK and Ireland, C&C is structurally integral to the markets we serve. We have continued to build the value of our brands, to invest in our insight capability, improved the efficiency of our logistics network and continued to sharpen our focus on our ESG objectives. We also de-listed from the Euronext Dublin and joined the FTSE 250 in December 2019, with the London Stock Exchange our primary and sole listing.

In addition we had a senior leadership transition within C&C during 2020. Following a thorough executive recruitment process, on 9 July 2020 we announced the appointment of David Forde as Group CEO. David took up his position and joined the Board on 2 November 2020. We believe David has the requisite blend of market and sector expertise to maximise the potential of our iconic brands and our distribution capabilities. In July 2020 we also announced the appointment of Patrick McMahon as Group CFO. Having originally joined C&C in 2005 Patrick has an inimitable understanding and experience of our business, with previous experience as Group Finance Director, Finance Director of a number of C&C’s business units and most recently, Group Strategy Director. As we navigate the current challenges and uncertainty of COVID-19, these appointments provide the leadership, insight and capability to deliver long term value for all our stakeholders.

As the COVID-19 situation continues to evolve, we have taken a number of steps to protect our colleagues, business partners, community and customers; ensure our supply chain and production facilities remain operational; and support the hospitality sector with measures to facilitate fully compliant operations in line with guidelines and regulations. We also continue to seek opportunities to ease the burden on those in greatest need during this crisis. Recently, this has seen the donations of water, soft drinks and juices together with a range of sponsorship initiatives for various community groups.

We continue to work proactively to maximise cash and have been able to maintain strong liquidity with a supportive lending syndicate. The Group successfully issued approximately €140 million of new US Private Placement notes in March 2020 to diversify, strengthen and extend the maturity of our capital structure and sources of debt finance. In addition, we successfully negotiated covenant waivers from our lenders up to, but not including, the August 2022 test date whether or not the rights issue is successful as outlined in detail in Note 20 of the Consolidated Financial Statements. While the Board recognises the absolute importance of dividend income for shareholders, given the focus on preserving cash, and the Group’s decision to avail of government support through this crisis, we did not declare a final dividend for FY2020 and FY2021. However, we intend to re-instate our dividend policy as and when it is appropriate.

Executive Remuneration Outcomes for FY2021

The Committee has continuously monitored remuneration decisions being taken across the Group and has considered executive pay in the context of the wider workforce and the broader impact on society, the Company and its shareholders.

While the final level of that impact was unclear, the Committee considered it prudent to delay certain key decisions in the first half of FY2021. Consequently, all decisions on salary, bonuses and share awards for FY2021 were deferred until September, following the completion of our half year. This decision was made to ensure that the Committee, had a clearer line of sight over expected performance and the full impact of COVID-19 on the business prior to implementing any decisions and setting performance targets. In implementing the decision, the Committee had the full support of Executive Management.

In September 2020, a review was undertaken and it was determined in view of the continued uncertainty that no bonus targets would be set for FY2021. As outlined below, no bonuses are to be paid to Executive Directors in respect of FY2021.

Salary

In response to the rapid emergence of the pandemic, and as part of the actions announced to preserve cash and reduce costs, there was an average reduction in salary of approximately 20% across the workforce. Management and Board remuneration reduced by 30% and 40% respectively for a three month period until the end of June 2020. Whilst salaries across the workforce returned to normal rates, Directors chose to extend the reduction for the period of July and August 2020 at the rate of 20% to reflect the ongoing economic situation and the experience of the Group’s wider stakeholders.

The following are the base salaries for our new CEO, David Forde and our new CFO, Patrick McMahon and our existing Group Chief Operating Officer (COO), Andrea Pozzi:

- David Forde: €690,000

- Patrick McMahon: €420,000 (with effect from appointment to the Board)

- Andrea Pozzi: £321,300 (unchanged from March 2019)

The total fixed pay for our new CEO and CFO is significantly less than the previous CEO and CFO reflecting both the lower base salaries and the 5% cap on pension contributions.

FY2020 and FY2021 Bonus

As outlined in our 2020 Directors’ Remuneration Report, mindful of the Company’s commitment to preserve cash and lower operating expenses, final approval of the bonuses earned by the Executive Directors (including the former CEO and CFO) based on performance during the twelve months ending February 2020 were deferred. These FY2020 bonuses were approved in October, with Executive Directors receiving a pay-out of 25% of salary as a result of achieving the cash conversion metric. Andrea Pozzi’s bonus was also subject to an under pin regarding brand redistribution which was not achieved, resulting in a pay-out of 12.5% of salary.

Given the current financial year commenced in March 2020, at the same time as the outbreak of COVID-19 and the associated government restrictions, no bonuses are to be paid to Executive Directors in respect of FY2021.

2018 LTIP and ESOS Awards

The three year performance period in respect of the 2018 LTIP and ESOS awards came to an end, based on the targets set in 2018 - namely EPS growth, free cash flow conversion and growth in ROCE – these were not met over the three year performance period ended 28 February 2021 and the awards lapsed.

Long-Term Incentives Awarded in FY2021

Given the uncertain outlook associated with COVID-19 and in line with guidance from the Investment Association, the grant of our FY2021 LTIP awards was also deferred from the normal grant date for a period of six months. In determining the quantum of the FY2021 LTIP and the proposed measures and targets, the Committee was sensitive to the need to balance incentivising executive performance (including a newly appointed CEO and CFO) at a time when our management teams are being asked to demonstrate significant leadership and resilience whilst ensuring that the Executive’s experience is commensurate with that of shareholders, employees and other stakeholders. The Committee was also conscious of ensuring that the newly constituted management team have a meaningful long-term equity component so as to ensure alignment with shareholders’ interests as we enter an important phase for the business.

Taking all of these factors in account, including the circa 30% fall in share price since the 2019 LTIP awards were granted, the Committee determined that our new CEO, new CFO and the COO would be granted LTIP awards of 134% of their respective contractual salaries. This represents a reduction of 16% of salary compared to our normal LTIP award levels of 150%.

The Committee faced considerable challenge in establishing meaningful and robust performance measures and targets for the FY2021 LTIP awards. This reflects the backdrop of COVID-19 with its already significant and disproportionate impact on the business and the industry compared to the broader economy and the associated forward looking continued uncertainty. The Committee therefore determined that for the FY2021 LTIP only three separate performance conditions, aligned to the Company’s key priorities for each of the three years in the performance period, will be set and assessed over the relevant year. No proportion of the award will vest until the end of the full three year period and the whole award will be subject to an overriding three year financial performance assessment. Further information in relation to the awards is detailed below. For the avoidance of doubt, the Committee does not intend to continue this approach after this LTIP cycle.

Under the terms of the LTIP award, the Committee has full discretion to reduce awards to ensure that the final outturn of the LTIP reflects all relevant factors, including consideration of any potential for windfall gains.

LTIP Performance Conditions

Performance conditions for FY2021 LTIP awards

The vesting of the FY2021 LTIP awards will be subject to an assessment of the Company’s underlying financial performance across the three year performance period FY2021 – FY2023. Each award will also be subject to three separate performance conditions aligned to the Company’s key priorities for each of the three years in the performance period and assessed over the relevant year, as set out below.

Threshold vesting in respect of any year will be no more than 25%, but subject to the overriding three year financial performance assessment. No award will vest until the end of the full three year period, and Executive Directors’ awards will then be subject to a further two year holding period.

Year | Weighting | Measure | Further detail | |

FY2021 | 30% | Liquidity | The use of a liquidity measure reflects our absolute focus on liquidity for the business in our response to the COVID-19 pandemic, and is fully aligned with other actions we have taken to strengthen the Group’s liquidity. The targets and vesting schedule (subject to the assessment of underlying financial performance over the full three year period) are as follows: | |

FY2021 Liquidity1 | Vesting | |||

Less than €250 million | 0% | |||

€250 million2 | 25% | |||

€300 million2 | 100% | |||

1 Cash on hand plus availability under the Group’s Revolving Credit Facility as at the end of FY2021 but excluding any possible proceeds from the UK’s COVID-19 Corporate Finance Facility. 2 Straight line vesting between €250 million and €300 million. | ||||

FY2022 | 35% | Net Debt to EBITDA | In the second year of the three year performance period, we anticipate that the current extreme impact of the COVID-19 pandemic on the industry will have reduced, such that the business will be able to focus on establishing the foundations for recovery. Therefore, for this year, we propose to set targets based on a Net Debt to EBITDA measure, reflecting our strategic priority of ensuring the appropriate level of financial gearing and profits to service debt. Those targets will be disclosed in the FY2022 Directors’ Remuneration Report. | |

FY2023 | 35% | Financial measures | By the third year of the three year performance period, we anticipate that recovery from the COVID-19 pandemic and the establishment of foundations for recovery will enable us to revert to more typical financial performance measures. We currently expect that the measures will be based on earnings, cash conversion and ROCE. The details of the measures (including the weightings, and targets) will be established towards the start of FY2023 and will be disclosed in the FY2023 Directors’ Remuneration Report or, if determined before its finalisation, in the FY2022 Directors’ Remuneration Report. | |

David Forde forfeited remuneration

As announced in his appointment release, David Forde forfeited cash remuneration from his previous employment to join C&C. This included the forfeiture of a retention payment payable in cash at the end of July 2021 with a value of €1,368,785.

To align David Forde’s interests with those of C&C’s shareholders, compensation for this forfeited remuneration was made through an award of C&C shares with an equivalent value of €1,368,785. In addition, David Forde’s contractual arrangements with his former employer meant that by resigning to join C&C he was subject to an eight week break in employment, in respect of which his loss of fixed remuneration was €103,250. We also agreed to compensate David Forde for this loss of remuneration but, notwithstanding that fixed remuneration was forfeit, agreed with David Forde that half of it would be awarded in C&C shares and half of it in a cash payment. Structuring the compensation as an award over Company shares provides an immediate alignment with shareholders’ interests and the delivery of our short and long term strategic priorities.

The share award was granted at the earliest available opportunity, on 3 November 2020, over 842,636 C&C shares in aggregate with a value of €1,420,410. Reflecting the fact the forfeited remuneration bought out was guaranteed cash based remuneration, the share price at the date of grant was used to calculate the number of shares to ensure the value was equal to the remuneration forfeited. The award will vest in respect of 50% of the shares in November 2022 and 50% of the shares in November 2023. After sales of shares to cover tax, David Forde will be required to retain 50% of the shares acquired in satisfaction of our Executive Director shareholding requirement (see page 129 for further details).

In order to give flexibility as to the basis on which the share award may be settled, we are seeking shareholder approval at the 2021 AGM to settle the award with new issue or treasury shares (on the basis that any such shares would count against the dilution limits included in the Company’s LTIP).

Remuneration Policy Review

In 2020, the Committee undertook a full review of the Policy. That review took account of market practice, shareholder expectations and best practice governance developments since our last review in 2018. These matters were given careful consideration during the Policy review process. In particular, taking into account the Code provisions in relation to the alignment of Executive Director pensions with those of the wider workforce and the requirement to adopt a formal policy on post-employment shareholding requirements.

In addition to the post-employment holdings, the Committee were fully aware of the focus on Executive Director pensions and, more specifically, any difference between contributions for Executive Directors and those of the workforce. As part of the Policy that will be put to shareholders at the 2021 AGM, there is a cap on pension contributions for all future Executive Directors. The Committee is also aware of the expectation that contributions for incumbent Executive Directors are aligned with the majority of the workforce by the end of 2022, and we have set out a clear plan to achieve this for all current Executive Directors (as set out on page 112 of the Remuneration Policy).

The Policy will be proposed in the new Group CEO’s first year since appointment, being an opportune time to put in place a new three-year Policy designed to continue to drive the delivery of strategy and generate value for all stakeholders. The new Group CEO has reviewed the Group’s existing incentive framework and input into the Committee’s proposals prior to our consultation with shareholders in 2020 and 2021.

We consulted with shareholders extensively during the latter part of 2020 and the early part of 2021 when the 2021 Policy was being formulated to ensure that it aligned with the expectations of our shareholders. Engagement with our key investors was constructive and insightful.

Implementation of the Remuneration Policy in FY2022

Based on the continuation of the existing approach, the Committee intends to take the following approach to the implementation of the Policy for FY2022;

Salary

In light of the continuing business uncertainty and resulting disruption to the business, the Committee has agreed that executive salaries will remain unchanged for the year ahead, in line with the wider workforce.

Pension

In line with best practice and investor expectations, the pension contributions (or cash in lieu of pension) for Executive Directors will be capped at the level available for the majority of the Group’s workforce (currently 5% of salary). This 5% rate applies to both David Forde and Patrick McMahon from their appointment to the Board. For our COO, Andrea Pozzi, a phased decrease in pension has been proposed to align his pension with the wider workforce by 1 March 2023 (see page 112).

Annual Bonus

The Committee has decided to delay the establishment of any bonus scheme until later in the year once the wider impact of COVID-19 on the business is clearer. Nevertheless, in keeping with the current remuneration policy the intention is that 75% of the metrics for any bonus will be based on financial measures and the remainder on non-financial or strategic goals, which may include ESG measures.

Long-Term Incentives

The current intention is that awards of LTIPs will be made in late May / early June 2021. The Committee has yet to determine the performance measures, which may include EPS, free cash flow and return on capital employed along with an ESG based measure (with financial measures accounting for at least 75% of the awards). The Committee has determined that before the measures are set, it should review the first quarter’s trading and the latest assessment of any continuing measures to control the pandemic. The measures will be confirmed in the RNS when the awards are made.

Non-Executive Directors

There are no changes to how the Remuneration Policy will be applied for Non-Executive Directors other than the requirement to build up their individual shareholding to 50% of their annual base fee within 3 years of their appointment or within 3 years from the date of approval of the Remuneration Policy, if later.

Director Changes

Stewart Gilliland was appointed as interim Executive Chair from 16 January 2020 to ensure continuity of executive leadership while the Group recruited a new CEO, which we did in July 2020 with the appointment of David Forde.

In a further change, we also announced at that time the appointment of Patrick McMahon as CFO, successor to Jonathan Solesbury, who informed the Board of his intention to retire during the year.

Following the announcement of David’s appointment as CEO in July 2020, and to allow an orderly process of succession, the Board requested that Stewart Gilliland continued in his role as interim Executive Chair until David joined C&C in November, 2020, at which time Stewart reverted to the role of Non-Executive Chair.

Gender Pay Gap Disclosure

In April 2021 we published our latest Gender Pay Gap report for those entities with more than 250 UK employees, namely, Matthew Clark Bibendum Limited and Tennent Caledonian Breweries Limited. Details can be found on each business’s respective website.

We are committed to promoting equality, diversity and inclusion as we build a culture where everyone can progress. This includes ensuring that our colleagues are paid a fair and equitable rate for the work they do regardless of gender or other differences. Going forward we will continue to focus on areas that improve our gender pay gap.

Committee Evaluation

The evaluation of the Committee was completed as part of the 2020 external board evaluation process conducted by Independent Audit. An explanation of how this process was conducted, the conclusions arising from it and the action items identified is set out on page 84. The Committee has considered this in the context of the matters that are applicable to the Committee.

Shareholder Engagement

The Committee values open, ongoing engagement with major shareholders and key institutional investor bodies.

The overall tone from shareholders was positive and constructive and enabled us to understand what was important for the Committee to consider both from a policy perspective and regarding the challenges faced in FY2021.

We believe that our current and proposed 2021 Policy arrangements remain appropriate, a view shared by our major shareholders during the consultations. It was considered that the existing model is clearly understood, supports our culture and provides a foundation to restore shareholder value in the future.

As a Committee, we will continue to engage with shareholders and institutional investor bodies in the development of our remuneration policies and structures and will continue to emphasise the links to performance and to consider wider stakeholders.

Wider Workforce Remuneration and Employee Engagement

In line with the Code, the Company takes a fully aligned approach to remuneration throughout the organisation to support succession, as well as a culture of performance and ownership. The Company regularly engages directly with the workforce through a number of channels and on a wide range of topics, including pay. The Company’s annual engagement survey places a focus on employee satisfaction, and seeks details on a number of areas including competitive pay and benefits.

It is an important part of our values that all employees, not just management, have the opportunity to become shareholders in the Group. All employees with at least one month’s continuous service have the opportunity to participate in our Profit Sharing Scheme.

An aspect of the Code that we believe enhances business is the greater linkage between companies’ corporate governance and remuneration frameworks. The widening of the remit of Remuneration Committees to oversee employee rewards and ensure incentives are aligned with culture while simultaneously promoting greater consideration of the ‘employee voice’ in Board decision-making is a particularly positive step. My role as the Non-Executive Director responsible for engaging with HR is an invaluable resource when reviewing wider employee incentive arrangements.

Conclusion

I would like to express my appreciation to our major shareholders for helping us to develop our Policy. We value the opportunity to engage with shareholders to foster mutual understanding of expectations; and, to ensure shareholders have had an opportunity to raise any issues or concerns directly with the Board. I hope that you will join the Board in supporting the resolution to approve the 2021 Policy.

Helen Pitcher OBE

Chair of the Remuneration Committee

Remuneration at a glance

Remuneration Outcomes as at 28 February 2021

Element | David Forde | Patrick McMahon | Andrea Pozzi |

Base salary as at 28 February 2021 | €690,000 | €420,000 | £321,300 |

Pension (% of base salary) | 5% | 5% | 25% |

Benefits | 7.5% | 7.5% | 7.5% |

Annual Bonus (% of max) | 0% | 0% | 0% |

LTIP (% of max) | 0% | 0% | 0% |

Annual Bonus Outcomes

As described, given the financial year commenced in March 2020, at the same time as the outbreak of COVID-19 and the associated government restrictions, no bonus scheme was established and no bonuses are to be paid to Executive Directors in respect of FY2021.

LTIP Outcome

The 2018 LTIP award of 100% of base salary and 2018 ESOS award of 150% granted to Andrea Pozzi in respect of the three year performance period ended on 28 February 2021 did not meet the performance conditions and the awards lapsed in full. David Forde and Patrick McMahon did not hold any awards under the 2018 LTIP and 2018 ESOS.

COVID-19 Impact on Executive Remuneration

The following table sets out the key components of executive remuneration and the decisions made by the Committee

Element of Remuneration | Committee decision | Rationale |

2021 temporary salary reductions | Base salaries were reduced for 5 months for Executive Directors together with a reduction in the Chair’s fee. Whilst not a decision made by the Committee, there was a corresponding reduction in the fees paid to the Non-Executive Directors. | The Committee took into consideration the wider stakeholder experience, including employees, shareholders, customers and the communities in which we operate and considered it appropriate to apply the temporary reduction. |

2020-2021 bonus plan outcome | No bonus scheme was established in the financial year. | Given the financial uncertainty, the Committee and the Board did not believe it appropriate to establish a bonus scheme. |

2018 LTIP and ESOS vesting | No adjustments to the awards were made during the year. The awards lapsed in full in line with performance against the targets. | The awards lapsed in accordance with the level of achievement against the performance conditions. |

2021-2022 bonus plan design | No bonus plan has yet been established for Executive Directors in the financial year. | Given the impact of COVID-19, the Committee and the Board did not believe it appropriate to establish a bonus scheme at the present time. |

2020 LTIP award | The multiple of salary applied to determine the award was reduced. This takes into account the fall in the share price as a consequence of the impact of the COVID-19 pandemic on the business. The awards are subject to three separate performance conditions aligned to the Company’s key priorities for each of the three years in the performance period, more information in relation to which is included on page 105; as described on page 105 the awards are subject to an assessment of underlying financial performance over the full three year period. | The Committee decided to reduce the multiple of salary used to determine the number of shares to be awarded to Executive Directors and decided that the multiple of salary for the 2020 award would be reduced from 150% to 134% of salary. The Committee has faced considerable challenge in establishing meaningful and robust performance measures and targets for the FY2021 LTIP awards. No proportion of the awards will vest until the end of the full three year period and vesting of any part is subject to an overriding three year financial performance assessment. |

2021 salary review | Base salaries will remain unchanged in FY2022. | The Committee took into consideration the wider stakeholder experience, including employees, shareholders, customers and the communities in which we operate and considered it appropriate for salaries to remain unchanged for FY2022. |

Remuneration Policy

Introduction

The current Remuneration Policy for Directors applied from the date of the 2018 AGM (2018 Policy). In line with typical UK practice, we are seeking approval for a new Remuneration Policy (the 2021 Policy) at the 2021 AGM. The 2021 Policy is set out below, and before that we have set out our approach to the design of the 2021 Policy and a summary of the key proposed changes between the 2018 Policy and the 2021 Policy.

Designing the 2021 Policy

The 2021 Policy has been designed to continue to drive the delivery of strategy and generate value for all stakeholders under the leadership of our new CEO and CFO. We have also taken into account market practice, shareholder expectations, wider workforce pay and polices and best practice governance developments since our last Policy review (including the 2018 UK Corporate Governance Code). Overall we consider that the current remuneration framework remains fit for purpose. Therefore, the changes proposed are to provide further alignment with best practice and to ensure sufficient flexibility over the next three years.

When designing remuneration policies and principles, having regard to the Code, the Committee has applied the following principles:-

- clarity – remuneration arrangements will be transparent and promote effective engagement with shareholders and the workforce;

- simplicity – remuneration structures will avoid complexity and their rationale and operation should be easy to understand;

- risk – remuneration arrangements will ensure reputational and other risks from excessive rewards, and behavioural risks that can arise from target-based incentive plans, are identified and mitigated;

- predictability – the range of possible values of rewards to individuals and other limits or discretions will be identified and explained;

- proportionality – the link between individual awards, the delivery of strategy and the long-term performance of the company will be clear; and,

- alignment to culture – incentive plans will drive behaviours consistent with company purpose, values and strategy.

We have set out below information on the key proposed changes to the 2018 Policy.

- Pension: In line with best practice and investor expectations, the 2021 Policy reduces the Executive Directors’ pension contributions (or cash in lieu of pension) from the 25% of salary level in the 2018 Policy. For David Forde, Patrick McMahon and any other Executive Director appointed after 1 March 2021, the contribution is reduced to the level available for the majority of the Group’s workforce (currently 5% of salary). For our COO, Andrea Pozzi, a phased decrease in pension has been proposed to align his pension with the wider workforce by 1 March 2023 in accordance with which: (1) his pension contribution has reduced to 20% of salary with effect from 1 March 2021; (2) will reduce to 10% of salary with effect from 1 March 2022; and (3) will be reduced to the level available for the majority of the Group’s workforce with effect from 1 March 2023.

- Maximum annual bonus: We are increasing the overall maximum annual bonus opportunity to 125% of salary. While there is no change in the maximum bonus potential for FY2022 which will remain at 100% of salary, this increase in headroom is to provide flexibility for the business during the lifetime of the 2021 Policy. Any future increase in the annual bonus potential will be considered alongside the level of stretch inherent in the targets set.

- On-target annual bonus: In line with best practice, the maximum on-target bonus will be capped at 50% of the maximum bonus potential (currently capped at 60% of maximum). This change will apply for FY2022.

- Increase annual bonus deferred into shares: To provide further alignment with shareholders, we are increasing the proportion of the bonus deferred into shares. Under the new policy up to 50% of any bonus earned will ordinarily be paid in cash with the remainder deferred into shares. The deferral period is also being increased to three years from the two years that applies under the 2018 Policy.

- Annual bonus measures: We will retain flexibility under the new 2021 Policy to set measures and targets annually reflecting the Company’s strategy and aligned with key financial, operational, strategic and/or individual objectives. The approach to the measures for the FY2022 bonus is described on page 113.

- Long term incentive plan: No changes are proposed to the LTIP quantum under the new 2021 Policy of up to 150% of salary (300% in exceptional circumstances). The three year performance period and two year holding period will continue to apply. As described on page 114 the performance measures for the FY2022 LTIP are intended to be based on EPS, Cash Conversion and ESG targets measured over a three year performance period, and the measures and targets will be confirmed in due course and announced when the awards are granted.

- In-service shareholding guidelines: The 2018 Policy includes a shareholding requirement of 200% of salary for the CEO and 100% of salary for other Executive Directors. This guideline will be increased to 200% of salary for all Executive Directors.

- Post-employment shareholding guidelines: We have introduced a post-employment requirement pursuant to which an Executive Director must retain 100% of their in-service shareholding requirement for 12 months following cessation and half of their in-service requirement for a further 12 months following cessation. The requirement applies only to shares acquired from LTIP and deferred bonus awards granted after 1 March 2021. We consider that this “tapered” approach, in the light of the two year holding period for LTIP awards and the introduction of bonus deferral, is a balanced way of ensuring alignment with longer term shareholder interests.

- Governance changes: Minor changes to the 2018 Policy to reflect governance changes are also proposed, which will update the malus and clawback provisions for variable pay, enhance discretion to override formulaic outturns on variable pay awards, and clarify the approach to dividend equivalents.

Summary

We believe the proposed 2021 Policy includes a range of enhancements which align C&C’s remuneration structures with best practice and with the expectations of our shareholders. Our approach is intended to ensure we motivate our management team to deliver against stretching performance targets whilst ensuring their interests are aligned not only with shareholders’ interests but also with those of wider stakeholders.

General statement of policy

The main aim of the Group’s policy on Directors’ remuneration is to attract, retain and motivate Directors of the calibre required to promote the long-term success of the Group. The Committee therefore seeks to ensure that Directors are properly, but not excessively, remunerated and motivated to perform in the best interests of shareholders, commensurate with ensuring shareholder value.

The Committee seeks to ensure that Executive Directors’ remuneration is aligned with shareholders’ interests and the Group’s strategy. Share awards are therefore seen as the principal method of long-term incentivisation. Similar principles are applied for senior management, several of whom have material equity holdings in the Company.

Annual performance-related rewards aligned with the Group’s key financial, operational and strategic goals and based on stretching targets are a further component of the total executive remuneration package. For senior management, mechanisms are tailored to local requirements.

The Group seeks to bring transparency to executive Directors’ reward structures through the use of cash allowances in place of benefits in kind. In setting Executive Directors’ remuneration, the Committee has regard to pay levels and conditions applicable to other employees across the Group.

The 2021 Policy

If the 2021 Policy is approved at the 2021 AGM, it will apply from that date.

Future Policy Table

Executive Directors

The table below sets out the Company’s Remuneration Policy for Executive Directors.

Purpose and link to strategy | Operation | Maximum opportunity | Performance metrics |

Salary | |||

Reflects the individual’s role, experience and contribution. Set at levels to attract, recruit and retain Directors of the necessary calibre. | Salaries are set by the Committee taking into account factors including, but not limited to:

Typically, salaries are reviewed annually, with any changes normally taking effect from 1 March. | While there is no prescribed formulaic maximum, any increases will take into account the outcome of pay reviews for employees as a whole. Larger increases may be awarded where the Committee considers it appropriate to reflect, for example: increases or changes in scope and responsibility; to reflect the Executive Director’s development and performance in the role; or alignment to market level. Increases may be implemented over such time period as the Committee determines appropriate. | None. |

Benefits/cash allowance in lieu | |||

Ensures that benefits are sufficient to recruit and retain individuals of the necessary calibre. | The Group seeks to bring transparency to Directors’ reward structures through the use of cash allowances in place of benefits in kind. The cash allowance can be applied to benefits such as a company car and health benefits. Group benefits such as death in service insurance are also made available. Other benefits may be provided based on individual circumstances including housing or relocation allowances, travel allowance or other expatriate benefits. Benefits and allowances are reviewed alongside salary. | There is no prescribed maximum monetary value of benefits. Benefit provision is set at a level which the Committee considers appropriate against the market and relative to internal benefit provision in the Group and which provides sufficient level of benefit based on individual circumstances. | None. |

Pension/cash allowance in lieu | |||

Contributes towards funding later life cost of living. | Executive Directors may participate in the Company’s defined contribution pension scheme or take a cash allowance in lieu of pension entitlement (or a combination thereof). | The Company’s current CEO and CFO and any Executive Director appointed after 1 March 2021 A contribution and/or cash allowance not exceeding the level available to the majority of the Group’s workforce. The Company’s current COO A contribution and/or cash allowance:

| None. |

Annual bonus | |||

Motivates employees and incentivises delivery of annual performance targets which support the strategic direction of the Company. | Bonus levels are determined after the year end based on performance against targets set by the Committee. The Committee has discretion to vary the bonus pay out should any formulaic output not reflect the Committee’s assessment of overall business performance, or if the Committee considers the pay-out to be inappropriate in the context of other relevant factors including to avoid outcomes which could be seen as contrary to shareholder expectations. Up to 50% of any bonus earned will ordinarily be paid in cash with the remainder deferred into shares, for up to three years. Additional shares may be delivered in respect of deferred bonus award shares to reflect dividends over the deferral period. The number of additional shares may be calculated assuming the reinvestment of dividends on such basis as the Committee determines. Malus and clawback provisions will apply to the annual bonus. See the “Malus and clawback” section below for more details. | Maximum opportunity is 125% of base salary (100% in FY2022). | Performance is ordinarily measured over the financial year. The Committee has flexibility to set performance measures and targets annually, reflecting the Company’s strategy and aligned with key financial, operational, strategic and/or individual objectives. The majority of the bonus will be based on financial measures, such as profit and cash. The balance of the bonus will be based on financial or strategic targets such as brand equity and our ESG goals. In the case of financial measures, 25% of the bonus will be earned for threshold performance increasing to 50% for on-target performance and 100% for maximum performance. For non-financial measures, the amount of bonus earned will be determined by the Committee between 0% and 100% by reference to its assessment of the extent to which the relevant metric or objective has been met. |

LTIP | |||

Incentivises Executive Directors to execute the Group’s business strategy over the longer term and aligns their interests with those of shareholders to achieve a sustained increase in shareholder value. | Awards are made in the form of nil-cost options or conditional share awards, the vesting of which is conditional on the achievement of performance targets (as determined by the Committee). Vested awards must be held for a further two year period before sale of the shares (other than to pay tax). This holding period can be operated on the basis that:

The Committee retains discretion to adjust the outturn of an LTIP award, including to override the formulaic outcome of the award, in the event that performance against targets does not properly reflect the underlying performance of the Company, or if the Committee considers the pay-out to be inappropriate in the context of other relevant factors including to avoid outcomes which could be seen as contrary to shareholder expectations. Additional shares may be delivered in respect of vested LTIP award shares to reflect dividends over the vesting period and, if relevant, the holding period. The number of additional shares may be calculated assuming the reinvestment of dividends on such basis as the Committee determines. | Awards may be made up to 150% of salary in respect of any financial year. In exceptional circumstances the maximum award is 300% of salary in respect of any financial year. | Vesting is based on the achievement of challenging performance targets measured over a period of three years. Performance may be assessed against financial measures (including, but not limited to, EPS and Cash Conversion) and operational or strategic measures (which may include ESG measures) aligned with the Company’s strategy, provided that at least 75% of the award is based on financial measures. For the achievement of threshold performance against a financial measure, no more than 25% of the award will vest, rising, ordinarily on a straight-line basis, to 100% for maximum performance; below threshold performance, none of the award will vest. For non-financial measures, the amount of the award that vests will be determined by the Committee between 0% and 100% by reference to its assessment of the extent to which the relevant metric or objective has been met. |

Share-based rewards – all-employee plans | |||

Align the interests of eligible employees with those of shareholders through share ownership. | The C&C Profit Sharing Scheme is an all-employee share scheme and has two parts. Part A relates to employees in Ireland and has been approved by the Irish Revenue Commissioners (the Irish APSS). Part B relates to employees in the UK and is a HMRC qualifying plan of free, partnership, matching or dividend shares (or cash dividends) with a minimum three year vesting period for matching shares (the UK SIP). UK resident Executive Directors are eligible to participate in Part B only. There is currently no equivalent plan for Directors resident outside of Ireland or the UK. | Under the Company’s Irish APSS, the maximum value of shares that may be allocated each year is as permitted in accordance with the relevant tax legislation (currently €12,700, which is the combined value for the employer funded and employee foregone elements). Under the Company’s UK SIP the current maximum value of partnership shares that may be acquired is £750 per annum, with an entitlement to matching shares of £750 per annum. However, the Committee reserves the right to increase the maximum to the statutory limits (being £1,800 in respect of partnership shares, £3,600 in respect of matching shares and £3,600 in respect of free shares, or in any case such greater limit as may be specified by the tax legislation from time to time). | No performance conditions would usually be required in tax-advantaged plans. |

Shareholding guidelines

In-service requirement

Executive Directors are required to build and maintain a personal shareholding of at least two times’ salary.

Executive Directors are required to retain 50% of the after tax value of vested share awards until the shareholding guideline is met.

Shares subject to awards which have vested but which remain unexercised, shares subject to LTIP awards which have vested but not been released (i.e. which are in a holding period) and shares subject to deferred bonus awards count towards the shareholding requirement on a net of assumed tax basis.

Post-employment requirement

The Committee has adopted a post-employment requirement. Shares are subject to this requirement only if they are acquired from LTIP or deferred bonus awards granted after 1 March 2021. For the first year after employment the Executive Director is required to retain such of those shares as have a value equal to the “in-service” guideline, or their actual shareholding, if lower, and for a further year such of those shares as a have a value equal to half of the “in-service” guideline or their actual shareholding, if lower.

Explanation of performance measures

Performance measures for the LTIP and annual bonus are selected by the Committee to reflect the Company’s strategy. In the case of both the annual bonus and the LTIP, the majority of the award (at least 75% in the case of the LTIP) will be based on financial measures, with any balance based on operational or strategic measures which reward the Executive Directors by reference to the achievement of objectives aligned with future successful implementation of the Company’s strategy. The Committee has discretion to set performance measures (and weightings where there is more than one measure) on an annual basis to take account of the prevailing circumstances. Measures and weightings may vary depending upon an Executive Director’s area of responsibility.

Targets are set annually by the Committee having regard to the circumstances at the time and taking into account a number of different factors.

To the extent provided for in accordance with any relevant amendment power under the rules of the share plans or in the terms of any performance condition, the Committee may alter the performance conditions relating to an award or option already granted if an event occurs (such as a material acquisition or divestment or unexpected event) which the Committee reasonably considers means that the performance conditions would not, without alteration, achieve their original purpose. The Committee will act fairly and reasonably in making the alteration so that the performance conditions achieve their original purpose and the thresholds remain as challenging as originally imposed. The Committee will explain and disclose any such alteration in the next remuneration report.

Malus and clawback

In line with the UK Corporate Governance Code, malus and clawback provisions apply to all elements of performance-based variable remuneration (i.e. annual bonus, and LTIP) for the Executive Directors. The circumstances in which malus and clawback will be applied are if there has been in the opinion of the Committee a material mis-statement of the Group’s published accounts, material corporate failure, significant reputational damage, error in assessing a performance condition, or the Committee reasonably determines that a participant has been guilty of gross misconduct. The clawback provisions will apply for a period of two years following the end of the performance period; in the case of any deferred bonus award or LTIP award which is not released until the end of a holding period, clawback may be implemented by cancelling the award before it vests/is released.

Share plans and other incentives

The Committee may operate the Company’s share plans in accordance with their terms and exercise any discretions available to them under the plans, including that awards may be adjusted in the event of a variation of capital, demerger, special dividend or other relevant event. Awards may be settled, in whole or in part, in cash, although the Committee would only settle an Executive Director’s award in cash in appropriate circumstances, such as where there is a regulatory restriction on the delivery of shares or as regards the tax liability arising in respect of the award.

In the event of a change of control or other relevant event, awards under the share plans will vest to the extent determined in accordance with the rules of the plans, after the exercise, where relevant, of any applicable discretion.

- Unvested LTIP awards will vest taking into account the performance conditions and pro-rating for time, although the Committee has discretion not to apply time pro-rating.

- Vested LTIP awards which are in a holding period will be released to the extent already determined.

- Deferred bonus awards will vest in full.

- Awards under the all-employee plans will vest in accordance with the rules of those plans, which do not provide for any discretionary treatment.

Legacy payments

The Committee reserves the right to make any remuneration payment or any payment for loss of office (including exercise any discretion in respect of any such payment) without the need to consult with shareholders or seek their approval, notwithstanding that it is not in line with the policy set out above, where the terms of the payment were agreed either:

- before the policy came into effect (provided that, in the case of any payment agreed after the Company’s 2015 Annual General Meeting, it is in line with the policy in effect at the time the payment was agreed); or

- at a time when the relevant individual was not a Director of the Company and, in the opinion of the Committee, the payment was not in consideration for the individual becoming a Director of the Company.

For these purposes: the term ‘payment’ includes any award of variable remuneration; in relation to an award over shares, the terms of the payment are ‘agreed’ at the time the award is granted.

Minor changes

The Committee may, without the need to consult with shareholders or seek their approval, make minor changes to this Policy to aid in its operation or implementation taking into account the interests of shareholders.

Comparison with remuneration policy for employees generally

Remuneration packages for Executive Directors and for employees as a whole reflect the same general remuneration principle that individuals should be rewarded for their contribution to the Group and its success, and the reward they receive should be competitive in the market in which they operate without paying more than is necessary to recruit and retain them.

The remuneration package for Executive Directors reflects their role of leading the strategic development of the Group. Accordingly there is a strong alignment with shareholders’ interests, through long term performance-based share rewards. Senior management are similarly rewarded.

These rewards are not appropriate for all employees but it is the Committee’s policy that employees in general should be afforded an opportunity to participate in the Group’s success through holding shares in the Company through all-employee plans.

Executive Directors are incentivised through an annual cash bonus to achieve shorter term objectives and all employees are similarly incentivised. The deferral of bonus for the Executive Directors increases their alignment with the longer term interests of shareholders.

For Executive Directors the remuneration package reflects the demands of a global market. For employees generally, remuneration and reward are tailored to the local market in which they work. It is the Committee’s policy that all employees should share in the success of the business divisions towards whose success they have contributed.

Consideration of employment conditions generally and consultation with employees

As described above, when setting the policy for Executive Directors’ remuneration, the Committee applies the same core principle as applied for the pay and employment conditions of other Group employees. When reviewing Directors’ remuneration, the Committee has regard to the outcome of pay reviews for employees as a whole.

The Committee did not directly consult with employees when formulating the Directors’ remuneration policy set out in this report and no remuneration comparison measurements comparing Executive Directors’ remuneration with employees were generally used.

The Group has regular contact with employee representatives on matters of pay and remuneration for employees covered by collective bargaining or consultation arrangements.

Illustration of remuneration policy

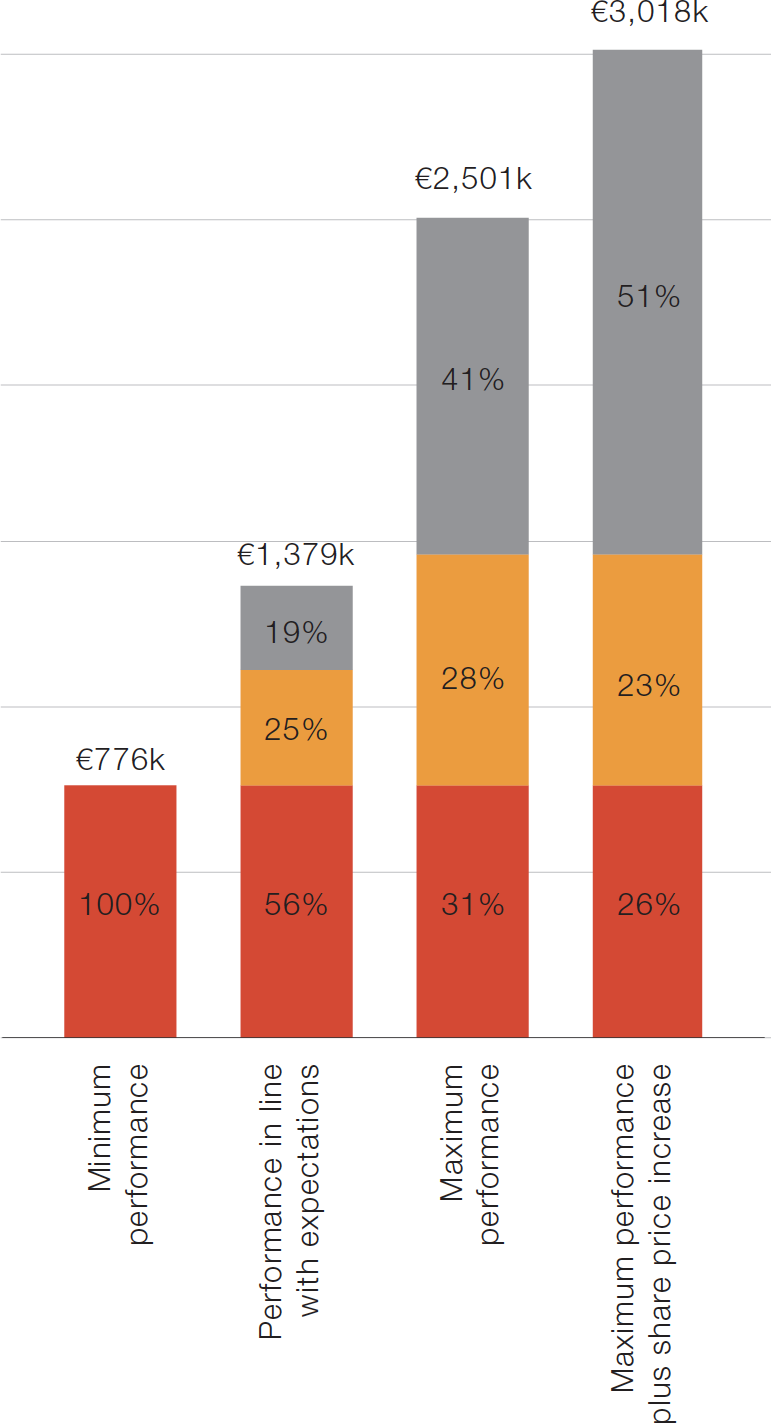

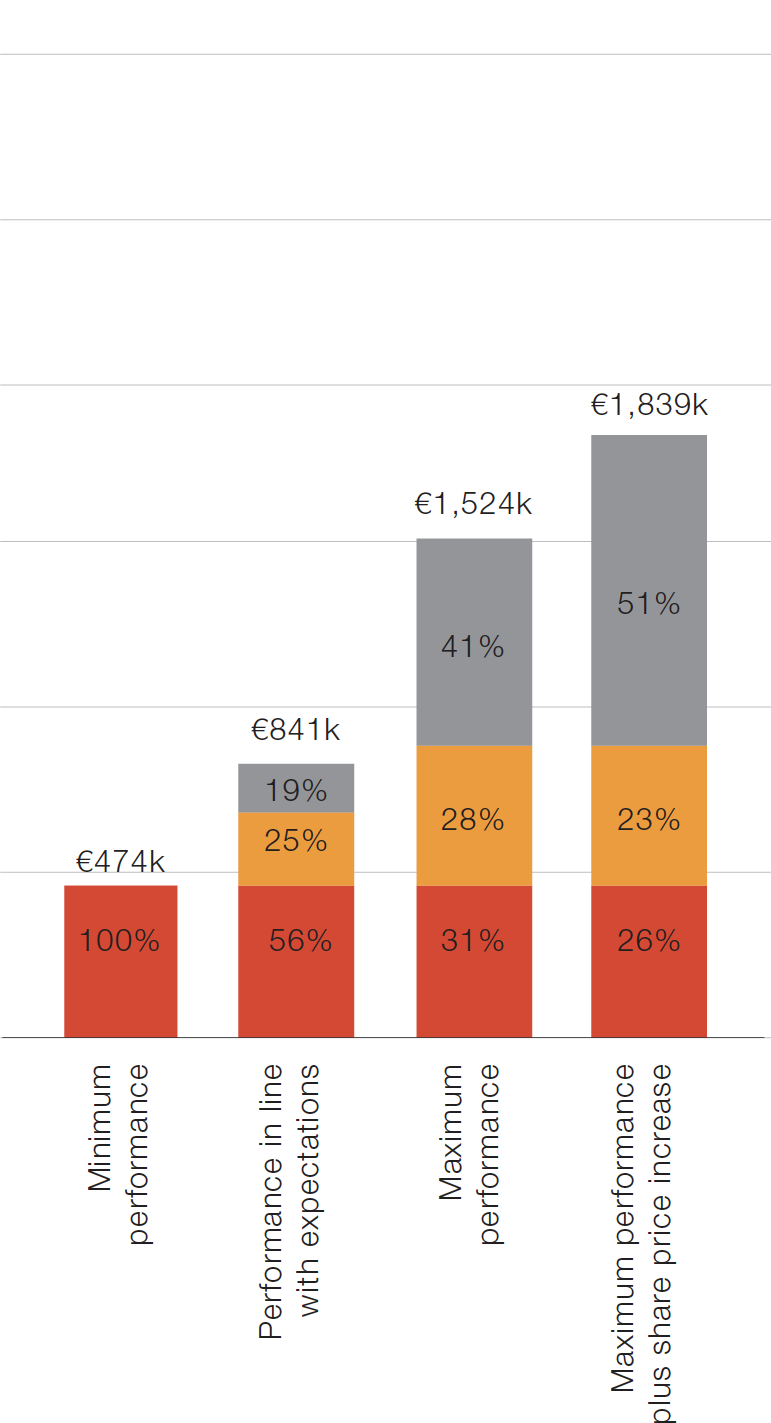

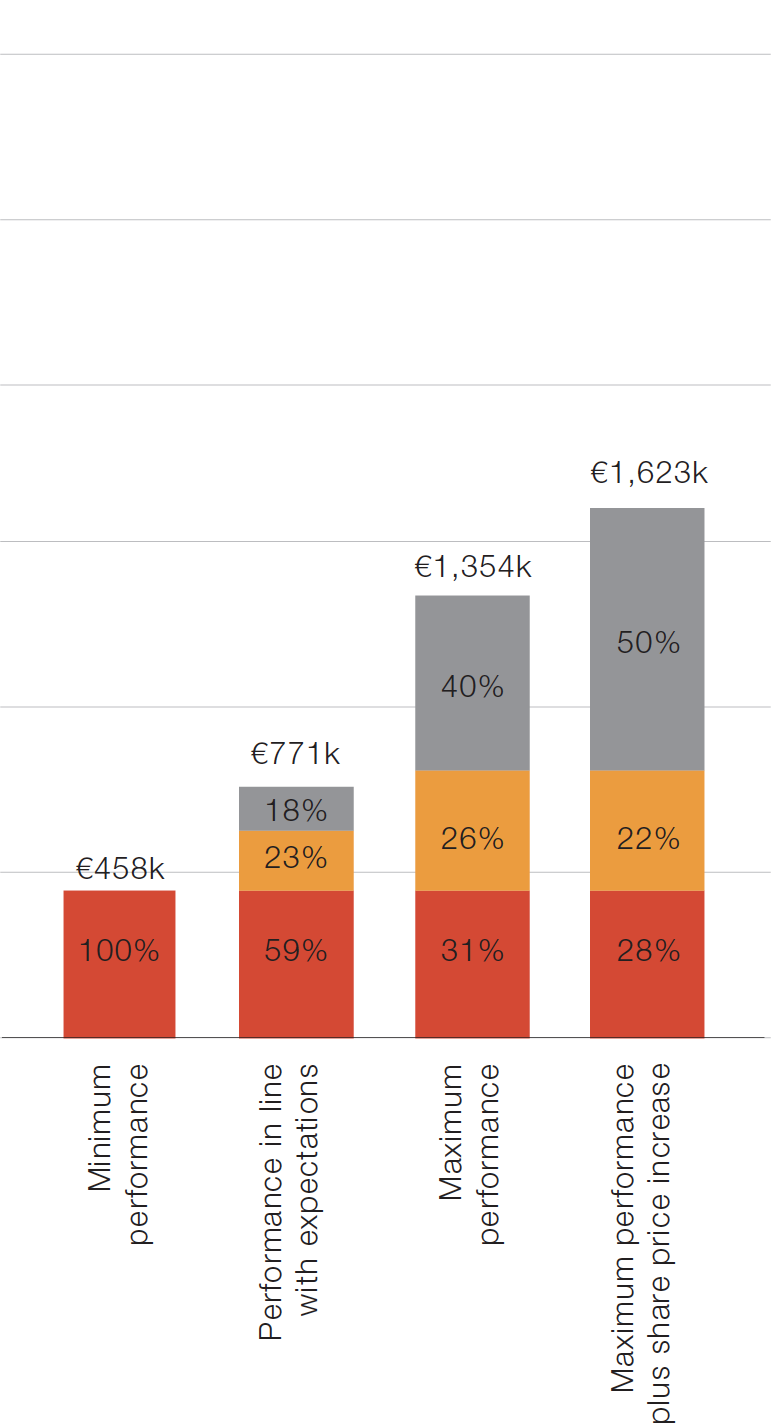

The following charts show the level of remuneration and the relative split of remuneration between fixed pay (base salary, benefits and cash allowance in lieu of pension) and variable pay (annual bonus and LTIP) for each Executive Director on the basis of minimum remuneration, remuneration receivable for performance in line with the Company’s expectations, maximum remuneration (not allowing for any share price appreciation) and maximum remuneration assuming a 50% increase in the share price for the purposes of the LTIP element.

David Forde

Patrick McMahon

Andrea Pozzi

Bases and Assumptions

For the purposes of the above charts, the following assumptions have been made:

- Base salary is the latest known salary as at 1 March 2021.

- Benefits as disclosed in the single figure table on page 124 for the year ended 28 February 2021, but “annualised” in the case of David Forde and Patrick McMahon to reflect that the value disclosed on page 124 is for a part year only.

- Cash allowance in lieu of pension for Executive Directors at the level of 5% of salary for David Forde and Patrick McMahon and 20% of salary for Andrea Pozzi (based on salary as at 1 March 2021).

- An annual bonus opportunity of 100% of salary

- An LTIP award of 150% of salary.

Where relevant, the average exchange rate for FY2021 has been used for ease of comparison.

In illustrating the potential reward the following assumptions have been made:

Minimum performance | Performance in line with expectations | Maximum performance | Maximum performance plus share price increase |

Fixed pay | |||

Fixed elements of remuneration (base salary, benefits allowance and pension allowance) | Fixed elements of remuneration (base salary, benefits allowance and pension allowance) | Fixed elements of remuneration (base salary, benefits allowance and pension allowance) | Fixed elements of remuneration (base salary, benefits allowance and pension allowance) |

Annual bonus | |||

No bonus | 50% of salary delivered for achieving target performance | 100% of salary delivered for achieving maximum performance | 100% of salary delivered for achieving maximum performance |

LTIP | |||

No vesting | 25% of the award (37.5% of salary) for achieving threshold performance | 150% of salary for achieving maximum performance | 150% of salary for achieving maximum performance plus an assumed 50% increase in the share price giving an overall value of 225% of salary. |

Recruitment remuneration policy

When recruiting a new Executive Director, the Committee will typically seek to use the Policy detailed in the table above to determine the appropriate remuneration package to be offered. To facilitate the hiring of candidates of the appropriate calibre required to implement the Group’s strategy, the Committee retains the discretion to make payments or awards which are outside the Policy subject to the principles and limits set out below.

In determining appropriate remuneration, the Committee will take into consideration all relevant factors (including the quantum and nature of remuneration) to ensure the arrangements are in the best interests of the Group and its shareholders. This may, for example, include (but is not limited to) the following circumstances:

- an interim appointment is made to fill an Executive Director role on a short-term basis;

- exceptional circumstances require that the Chair or a Non-Executive Director takes on an executive function on a short-term basis;

- an Executive Director is recruited at a time in the year when it would be inappropriate to provide a bonus or long-term incentive award for that year as there would not be sufficient time to assess performance. Subject to the limit on variable remuneration set out below, the quantum in respect of the months employed during the year may be transferred to the subsequent year so that reward is provided on a fair and appropriate basis;

- the Executive Director received benefits at his previous employer which the Committee considers it appropriate to offer.

The Committee may also alter the performance measures, performance period, vesting period, deferral period and holding period of the annual bonus or long-term incentive if the Committee determines that the circumstances of the recruitment merit such alteration. The rationale will be clearly explained.

The Committee may make an award to compensate the prospective employee for remuneration arrangements forfeited on leaving a previous employer. In doing so, the Committee will take account of relevant factors regarding the forfeited arrangements which may include the form of any forfeited awards (e.g. cash or shares), any performance conditions attached to those awards (and the likelihood of meeting those conditions) and the time over which they would have vested. These awards or payments are excluded from the maximum level of variable remuneration referred to below; however, the Committee’s intention is that the value awarded or paid would be no higher than the expected value of the forfeited arrangements.

Any share awards referred to in this section will be granted as far as possible under the Group’s existing share plans. If necessary, and subject to the limits referred to below, recruitment awards may be granted outside of these plans.

Recruitment awards will normally be liable to forfeiture or “clawback” on early departure (i.e. within the first 12 months of employment).

It would be the Committee’s policy that a significant portion of the remuneration package (including any introductory awards) would be variable and linked to stretching performance targets and continued employment. The maximum level of variable remuneration that may be granted to new Directors (excluding buy-out arrangements) is 425% of base salary.

Where a position is filled internally, any pre-appointment remuneration entitlements or outstanding variable pay elements shall be allowed to continue according to the original terms.

Fees payable to a newly-appointed Chair or Non-Executive Director will be in line with the fee policy in place at the time of appointment.

Policy on payment for loss of office

Executive Directors

Service Contracts

Details of the service contracts of the Executive Directors in office during the year are as follows:

Name | Contract date | Notice period | Unexpired term of contract |

David Forde | 2 November 2020 | 12 months | n/a |

Patrick McMahon | 8 July 2020 | 12 months | n/a |

Andrea Pozzi | 31 May 2017 | 12 months | n/a |

Compensation on Termination

The service contracts of the Executive Directors do not contain any pre-determined compensation payments in the event of termination of office or employment other than payment in lieu of notice.

The principles on which the compensation for loss of office would be approached are summarised below:

Policy | |

Notice period | None of the Executive Directors has a service contract with a notice period in excess of one year. Service contracts for new Directors will generally be limited to 12 months’ notice by the Company. |

Termination payment/payment in lieu of notice | The Company has retained the right to make payment to the Executive Director of 12 months’ fixed remuneration in lieu of the notice period. Discretionary benefits may also include, but are not limited to, outplacement and legal fees. |

Annual bonus | Payment of the annual bonus would be at the discretion of the Committee on an individual basis and would be dependent upon the circumstances of their departure and their contribution to the business during the bonus period in question. A departing Director may be eligible, depending on the circumstances and subject to performance, for payment of a bonus pro-rata to the period of employment during the year, to be payable at the usual time. |

Share based awards | The vesting of share based awards is governed by the rules of the relevant incentive plan. |

LTIPUnvested awards | ‘Good leavers’ typically include leavers due to death, injury, ill-health, disability, redundancy and retirement with the consent of the Company or business disposal or any other reason as determined by the Committee. The provisions for ‘good leavers’ provide that unvested awards will vest at the normal vesting point taking account of the performance over the period and subject to pro-rating for time, although the Committee has discretion to waive pro-rating for time. Any holding period would typically continue to apply. The Committee has the discretion to accelerate vesting (and release) to the date of cessation of employment (and to assess performance accordingly) or to determine vesting at the end of the performance period and to release the award then. |

LTIPVested but unreleased awards | Under the LTIP, if a participant ceases employment during a holding period, their award will continue unless he/she is summarily dismissed, in which case the award will lapse. Awards which are retained will typically be released at the originally anticipated release date. However, the Committee has discretion to release the award at the date of cessation. |

Deferred bonus awards | In the event of cessation due to death, ill-health, injury or disability, the deferred bonus share award would be released as soon as practicable following termination. In the event of cessation for any other reason (unless the participant is summarily dismissed, in which case the award will lapse), the award will be released at the normal time, although the Committee has discretion to release at cessation. |

Mitigation | Executive Directors’ service contracts contain no contractual provision for reduction in payments for mitigation or for early payment, and accordingly any payment during the notice period will not be reduced by any amount earned in that period from alternative employment obtained as a result of being released from employment with the Group before the end of the contractual notice period. |

Other payments | Payments may be made under the Company’s all employee share plans which are governed by the Irish Revenue Commissioners and HMRC tax-advantaged plan rules and which cover leaver provisions. There is no discretionary treatment of leavers under these plans. Payments may also be made in respect of accrued but untaken holiday and for fees for any outplacement services and legal and professional advice in connection with the termination. Where on recruitment a buy-out award had been made outside the LTIP 2015, then the applicable leaver provisions would be specified at the time of the award. |

The Committee reserves the right to make additional exit payments where such payments are made in good faith in discharge of an existing legal obligation (or by way of damages for breach of such an obligation) or by way of settlement or compromise of any claim arising in connection with the termination of a Director’s office or employment. In doing so, the Committee will recognise and balance the interests of shareholders and the departing Executive Director, as well as the interests of the remaining Directors. Where the Committee retains discretion it will be used to provide flexibility in certain situations, taking into account the particular circumstances of the Director’s departure and performance.

Non-Executive Directors

The table below sets out the Company’s Remuneration Policy for Non-Executive Directors

Purpose and link to strategy | Operation | Opportunity | Performance metrics |

Non-Executive Director fees | |||

Attract and retain high calibre individuals with appropriate knowledge and experience | Fees paid to Non-Executive Directors are determined and approved by the Board as a whole. The Committee recommends the remuneration of the Chair to the Board. Fees are reviewed from time to time and adjusted to reflect market positioning and any change in responsibilities. Non-Executive Directors are not eligible to participate in the annual bonus plan or share-based plans and, save as noted below, do not receive any benefits (including pension) other than fees in respect of their services to the Company. Non-Executive Directors may be eligible to receive certain benefits as appropriate such as the use of secretarial support, travel costs or other benefits that may be appropriate. If tax is payable in respect of any benefit provided, the Company may make a further payment to cover the tax liability. | Fees are based on the level of fees paid to Non-Executive Directors serving on Boards of similar-sized listed companies and the time commitment and contribution expected for the role. The Articles of Association provide that the ordinary remuneration of Directors (i.e. Directors’ fees, not including executive remuneration) shall not exceed a fixed amount or such other amount as determined by an ordinary resolution of the Company. The current limit was set at the Annual General Meeting held in 2013, when it was increased to €1.0 million in aggregate. | Not applicable. |

Additional Fees | |||

Provide compensation to Non-Executive Directors taking on additional responsibility | Non-Executive Directors receive a basic fee and an additional fee for further duties (for example chairship of a committee or Senior Independent Director responsibilities) or time commitments. | Not applicable. | |

Shareholding Guidelines | |||

Provide alignment of interest between Non-Executive Directors and shareholders | Non-Executive Directors build up their individual shareholding to 50% of their annual base fee within 3 years of their appointment or within 3 years from the date of approval of the Remuneration Policy, if later. An annual review against the guidelines is put in place, after Q4, which would allow 25% of the fee to be invested into stock if the current holding does not meet 50% of the annual base fee. The fee and the share price on the date of the fourth fee payment of the year is the test of whether the guideline is met. | Not applicable | |

Letters of appointment

Each of the Non-Executive Directors in office during the financial year was appointed by way of a letter of appointment. Each appointment was for an initial term of three years, renewable by agreement (but now subject to annual re-election by the members in General Meeting). The letters of appointment are dated as follows:

Non-Executive Director | Date of letter of appointment |

Stewart Gilliland | 17 April 2012 (Chair) |

Vineet Bhalla | 26 April 2021 |

Jill Caseberry | 7 February 2019 |

Jim Clerkin | 1 April 2017 |

Vincent Crowley | 23 November 2015 |

Emer Finnan | 4 April 2014 |

Helen Pitcher | 7 February 2019 |

Jim Thompson | 7 February 2019 |

The letters of appointment are each agreed to be terminable by either party on one month’s notice and do not contain any pre-determined compensation payments in the event of termination of office or employment.

Annual Remuneration Report

Remuneration in detail for the Year ended 28 February 2021

Directors’ Remuneration (Audited)

The following table sets out the total remuneration for directors for the year ended 28 February 2021 and the prior year.

Single Total Figure of Remuneration – Executive Directors (Audited)

The table below reports the total remuneration receivable in respect of qualifying services by each Executive Director during the year ended 28 February 2021 and the prior year. Stewart Gilliland was interim Executive Chair from 1 March 2020 until 2 November 2020, at which point he reverted to his role of Non-Executive Chair; given his current role, his remuneration for the whole year is included in the Single Total Figure of Remuneration Table for Non-Executive Directors on page 128.

Salary/fees (a) | Taxable benefits (b) | Annual bonus (c) | Long term incentives (d) | Pension related benefits (e) | Termination payments (f) | Miscellaneous (g) | Total | |||||||||

Year ended February | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 |

€’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | €’000 | |

Executive Directors | ||||||||||||||||

David Forde1 | 230 | - | 17 | - | - | - | - | - | 12 | - | - | - | 1,472 | - | 1,731 | - |

Stephen Glancey2 | - | 698 | - | 52 | - | 174 | - | 1,120 | - | 175 | - | 698 | - | 56 | - | 2,973 |

Patrick McMahon3 | 255 | - | 19 | - | - | - | - | - | 13 | - | - | - | - | - | 287 | - |

Andrea Pozzi | 311 | 368 | 27 | 28 | - | 46 | - | 544 | 90 | 92 | - | - | - | - | 428 | 1,078 |

Jonathan Solesbury4 | 137 | 497 | 13 | 37 | - | 124 | - | 1,020 | 48 | 124 | 641 | - | 37 | - | 198 | 1,802 |

Total | 933 | 1,563 | 76 | 117 | - | 344 | - | 2,684 | 163 | 391 | 641 | 698 | 1,509 | 56 | 3,322 | 5,853 |

The remuneration for Stephen Glancey, Jonathan Solesbury and Andrea Pozzi was translated from Sterling using the average exchange rate for the relevant year. For Executive Directors who joined or left in the year, salary, taxable benefits, annual bonus, long term Incentives and pension relates to the period in which they served as an Executive Director.

1. Figures for David Forde are from 2 November 2020, the date he joined the Board.

2. Stephen Glancey left the Board on 15 January 2020 and the Group on 29 February 2020. The remuneration referred to in the table above for FY2020 is the remuneration he earned for the full year.

3. Figures for Patrick McMahon are from 23 July 2020, the date he joined the Board.

4. Figures for Jonathan Solesbury are to 23 July 2020 (the date he left the Board) plus certain payments made to him in connection with the cessation of his employment on 31 August 2020 (following the conclusion of a handover period) as further described on page 125.

Details on the valuation methodologies applied are set out in Notes (a) to (g) below. The valuation methodologies are as required by the Regulations and are different from those applied within the financial statements, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”).

Notes to Directors’ Remuneration Table

(a) Salaries and fees

The amounts shown are the amounts earned in respect of the financial year.

(b) Taxable benefits

The Executive Directors received a cash allowance of 7.5% of base salary. The Group provided death-in-service cover of four times annual base salary and permanent health insurance (or reimbursement of premiums paid into a personal policy).

(c) Annual bonus

No bonus scheme was implemented in FY2021 due to the unpredictability of COVID-19.

(d) Long term incentives

1. The amounts shown in respect of long term incentives are the values of awards where final vesting is determined as a result of the achievement of performance measures or targets relating to the financial year and is not subject to achievement of further measures or targets in future financial years.

2. The awards granted in May 2018 in respect of the LTIP and ESOS, the performance conditions for these awards are detailed in note 4 (Share-Based Payments). These awards lapsed in full.

LTIP Performance Conditions

Performance condition | Weighting | Performance target | % of element vesting |

Compound annual growth in Underlying EPS over the three yearperformance period FY2019, FY2020 and FY2021 | 33% | ||

Threshold | 3% | 25% | |

Maximum | 8% | 100% | |

Free cash flow Conversion | 33% | ||

Threshold | 65% | 25% | |

Maximum | 75% | 100% | |

Return on Capital Employed | 33% | ||

Threshold | 9.3% | 25% | |

Maximum | 10% | 100% |

ESOS Performance Conditions

Performance condition | Performance target | % of element vesting |

Compound annual growth in Underlying EPS over the three yearperformance period FY2019, FY2020 and FY2021 | ||

Threshold | 2% | 25% |

Maximum | 6% | 100% |

Details of the performance conditions for the 2017 LTIP and ESOS awards were included in the Directors’ Remuneration Report last year.

(e) Pensions related benefits

No Executive Director accrued any benefits under a defined benefit pension scheme. Under their service contracts, Executive Directors received a cash payment of 25% of base salary (or 5% of salary for David Forde and Patrick McMahon) in order to provide their own pension benefits as disclosed in column (e) of the table.

(f) Termination payments

Stephen Glancey stepped down as Group Chief Executive Officer with effect from 15 January 2020 and left the Company on 29 February 2020. Details of payments made to Stephen Glancey in connection with his leaving the Company were included in the prior year Directors’ Remuneration Report.

Jonathan Solesbury retired from the Board as Group Chief Financial Officer on 23 July 2020 and left the business on 31 August 2020 following the conclusion of a handover period. Between 23 July 2020 and 31 August 2020 he continued to receive his basic salary and contractual benefits (with the basic salary subject to the 20% reduction referred to on page 103). Following his departure from the business, he received €641,129 in lieu of his notice period.

(g) Miscellaneous

The miscellaneous payments are: (1) in respect of 2020, a payment made to Stephen Glancey in relation to holiday entitlement, as disclosed in the Directors’ Remuneration Report for the year ended 29 February 2020; (2) in respect of 2021, the awards granted to David Forde to compensate him for remuneration forfeited to join C&C as referred to on pages 105 to 106; and (3) in respect of 2021, a payment of €37,221 made to Jonathan Solesbury in relation to holiday entitlement that was not taken at the time of stepping down from the Board.

Additional Information

Fees from external appointments

None

Payments to Former Directors and Payments for Loss of Office

There were no payments to former Directors or payments for loss of office other than those made to Jonathan Solesbury, as outlined above.

Directors’ Shareholdings and Share Interests

Shareholding guidelines

Executive Directors are required to build up (and maintain) a minimum holding of shares in the Company. Under the existing policy, the CEO was expected to maintain a personal shareholding of at least two times’ salary, while other Executive Directors were required to hold one times’ salary. This has been increased to two times’ salary for all Executive Directors under the new Policy.

Executive Directors are expected to retain 50% of the after tax value of vested share awards until at least the shareholding guideline has been met.